Exit Memo: Small Business Administration

SBA: Smart, Bold, Accessible

Administrator Maria Contreras-Sweet | January 5, 2017

Introduction

Small businesses are the cornerstone of the American Dream. They give us the freedom to chart our own paths and live to our fullest potential. They are the engines of American job creation, creating the majority of our new jobs, and are the wellspring of American innovation. Small business owners shape the character of our Main Streets and are the pillars of our communities.

Under President Obama, we at the U.S. Small Business Administration have been fighting to ensure that America’s entrepreneurs receive the support they need to succeed with unprecedented access to capital, counseling, and record-level federal contracting opportunities. SBA strives to be smart, bold and accessible: embracing smart systems and modern technology, promoting bold steps into new markets and ensuring entrepreneurship is accessible to Americans of all backgrounds.

Looking back on the economic crisis the nation faced eight years ago, I am awed by the strides made by this Administration and proud of the role that the SBA team has played in supporting that progress. America’s small businesses were hit hard by the Great Recession, and we responded with a comprehensive effort to encourage entrepreneurship and bolster job creation.

When private sector small business lending faltered, the SBA stepped into the breach, bridging the gaps and reaching record levels of lending support to America’s entrepreneurs. When small firms needed increased earnings to thrive and grow, we worked with small businesses to help them win record-shattering levels of contracts. When our heroic veterans needed help entering a difficult economy, we created new training programs – bringing entrepreneurial skills to more than 50,000 members of our military and their spouses. When underserved communities across the nation were struggling to rebuild, we launched a series of initiatives to boost entrepreneurship, lending, investment, and innovation.

When President Obama took office, American families were losing their livelihoods and their homes at staggering rates. Thanks to his leadership, the next Administration will inherit a small business economy that is strong and robust.

Record of Progress

In 2009, America was facing the worst economic crisis since the Great Depression. Real estate values had plummeted, credit markets were frozen, and banks had stopped lending. Job losses were severe, and small businesses were hit especially hard, losing a greater share of their jobs than big businesses. The way our economy bounced back from that difficult time is one of America’s greatest stories of resilience. Since 2010, U.S. businesses have added 15.6 million jobs, and the nation has seen the longest streak of total employment growth in our history. And, SBA is proud to say, about 10 million of those new jobs came from small businesses and startups.

Early in the crisis, SBA fought to protect small businesses from the worst of the downturn. As the economy rebounded, SBA worked to ensure that small businesses continued to share in that recovery. We have leveraged our agency’s tools and resources to drive success in these areas, and where the right tools did not exist, we worked with Congress to create new ones.

To do so, we have focused our efforts in four areas:

- Improving access to capital by modernizing our programs and systems.

- Expanding opportunities for entrepreneurs from every corner of our nation.

- Improving support structures for entrepreneurs and catalyzing high-growth, high-impact startups.

- Broadening access to global markets through exporting.

Improving Access to Capital by Modernizing SBA Programs

The SBA is the world’s largest business loan guarantor. Our flagship lending vehicles, the SBA Advantage Loan Program (or 7(a)) and the SBA Grow Loan Program (or 504), offer loan guarantees for small businesses that may not qualify for traditional bank loans. Since 2009, we have guaranteed $179 billion in small business loans, more than any other administration in history. Annual SBA lending in our largest program is up more than 160 percent since the depths of the recession. Last year, SBA guaranteed more than 70,000 loans, for a total of $28.9 billion, and supported more than 694,000 jobs across the country. Remarkably, at present both of these loan programs operate without any subsidy from the American taxpayer.

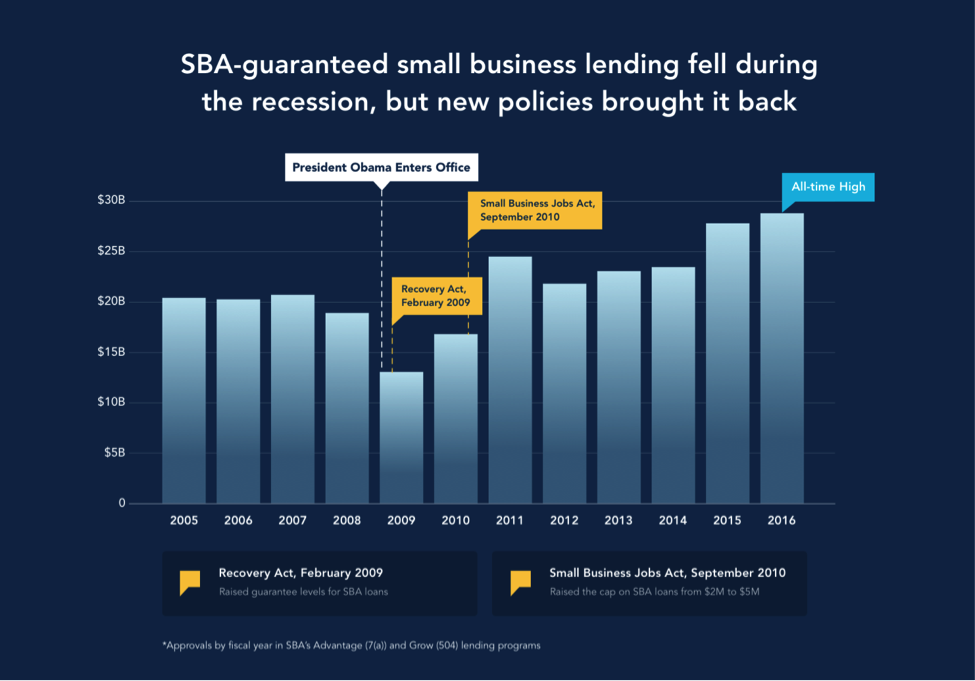

Making SBA loans more appealing to both lenders and borrowers. After lending came to a halt in the midst of the Great Recession, President Obama signed two pieces of legislation to stimulate small business lending. The Recovery Act of 2009 boosted the guarantee level of private sector loans guaranteed by the SBA. The Small Business Jobs Act of 2010 permanently increased the maximum size of an SBA loan to $5 million. The 2010 legislation also expanded the ability of small businesses to use SBA’s Grow (or 504) loan program to refinance real estate debt, providing entrepreneurs a vital lifeline when credit markets were tight and businesses’ collateral had suffered devastating declines in value. After a successful pilot, this program was made permanent in 2016.

This chart illustrates how successful these changes were in boosting SBA’s support for small business lending after lenders pulled back as a result of the crisis.

Using modern tools to streamline processes and simplify policies. We focused on making our loans simpler for borrowers by eliminating red tape and cutting processing times from 30 days on average to just seven days for Advantage loans under $350,000, and 20 days for higher-dollar Advantage loans.

We’ve launched a new online resource called SBA One, a free, intuitive, easy-to-use lending platform, with 2,500 lenders currently enrolled. SBA One is especially helpful to smaller lenders that lack advanced software or SBA expertise. SBA One also has increased the transparency of our risk management processes, enabling lenders to more proactively manage risk.

To help small business borrowers overcome the obstacle of finding a lender interested in working with them, we also launched Lender Match (formerly LINC), a matchmaking tool that connects lenders with potential borrowers through an online questionnaire. Since February 2015, Lender Match has connected more than 50,000 small businesses with lenders. We are already incorporating user feedback as SBA prepares to launch a new and improved version of the tool.

Financing the next generation of startups. In President Obama’s first term, the SBA created the Office of Investment and Innovation to consolidate its programs targeted toward high-growth, high-impact startups: the Small Business Investment Company (SBIC) and Small Business Innovation Research (SBIR) programs. Together, this suite of programs and services supports strong job creation and helps maintain America’s competitive edge in high-growth entrepreneurship, a key priority of the White House Startup America initiative. In 2014, in an effort to reach out to entrepreneurs, we added to the SBA’s core mission the deployment of field personnel to accelerators and incubators.

SBA’s capital portfolio extends beyond traditional lending. We also operate the world’s largest middle market “fund of funds” through the SBIC program, a public-private partnership that helps qualified fund managers invest in small businesses at no cost to the taxpayer. Working with Congress we raised the cap on the value of SBICs managed under common control, and raised the amount of financing available to SBICs each year. SBIC program licensees have expanded access to capital for small businesses by 50 percent since 2009, raising their portfolio from $16.8 billion to $27.8 billion in 2016. All told, SBICs invested more than $31 billion in small firms during the Obama Administration.

With the establishment of Impact and Early Stage SBICs, the agency also has steered much-needed capital to small businesses in low-income areas, socially impactful companies and early stage startups – sectors that often face particular challenges accessing capital.

Supporting disaster survivors when they most need help. Our Office of Disaster Assistance has been working hard to automate and streamline our application, approval, and disbursement processes for disaster assistance loans. In 2009, fewer than 30 percent of these loan applications were submitted electronically. Today, more than 90 percent of disaster loans are submitted electronically, shaving weeks off the time it takes for homeowners, renters, and small business owners to get the help they need to rebuild. For example, when Louisiana experienced historic flooding in August 2016, our loan processing teams used the latest technology to make ‘desktop’ assessments of damaged properties by downloading the footprints of affected homes and businesses. These improvements helped to ensure that those first, crucial funds got into the hands of home and business owners in a matter of days, not weeks. As a result, during this administration, the Office of Disaster Assistance has approved more than $8.6 billion in lending to communities hard hit by disasters.

Expanding Opportunities for Entrepreneurs from Every Corner of our Nation

A key part of the SBA’s mission is to ensure that entrepreneurship is a path forward for more Americans – especially those from underserved communities. The face of entrepreneurship is evolving, with women, African-American, and Hispanic entrepreneurs representing a larger share of small businesses than ever. By one estimate, women entrepreneurs are adding more than 1,000 new businesses in this country every day, and women of color account for roughly 80 percent of those.

The SBA has focused on outreach and serving all Americans, especially women, those in rural areas and struggling communities, veterans, and others. We have supported more Advantage (7(a)) loans than any prior administration, including, for example, increasing lending to women by 150 percent and to Hispanics by 279 percent since 2009.

Expanding our lending platforms to nonprofit, mission-based lenders. Increasing our small dollar loans is vital to reaching the underserved. To help us reach these entrepreneurs who often lack access to traditional lenders, we launched the Community Advantage Program to allow nonprofits, Community Development Financial Institutions, and other mission-based lenders to join our Advantage loan program. These lenders are required to make at least 60 percent of their Community Advantage loans in underserved markets, and nearly half of all loans in the program are for $100,000 or less. In the past two years, Community Advantage has grown more than 100 percent to a total of $340 million in loans. Small dollar lenders, such as credit unions, are now participating in this program.

With support from Congress, the SBA has also nearly doubled the size of its microloan program, which provides loans up to $50,000 alongside technical assistance through nonprofit lending intermediaries.

This fall, we participated in the announcement of the Partnership for Lending in Underserved Markets (PLUM) Initiative in Baltimore and Los Angeles, a two-year, pilot collaboration to develop models to assist African-American and Hispanic small business owners. In order to reduce recidivism, SBA supported the launch of the ASPIRE Initiative, which gives those re-entering society after being involved with the justice system a chance to create their own jobs through entrepreneurship. This public-private partnership is part of a larger effort to reduce barriers to employment and builds on action SBA took last year that makes individuals currently on probation or parole eligible for a SBA microloan.

Connecting small businesses with contracting opportunities and expedited payments. The federal government is the world’s largest buyer of goods and services. During President Obama’s first seven years in office, the federal government awarded more than $640 billion in federal procurement dollars to small businesses. Relative to the seven years before he took office, this represents an increase of more than $125 billion.

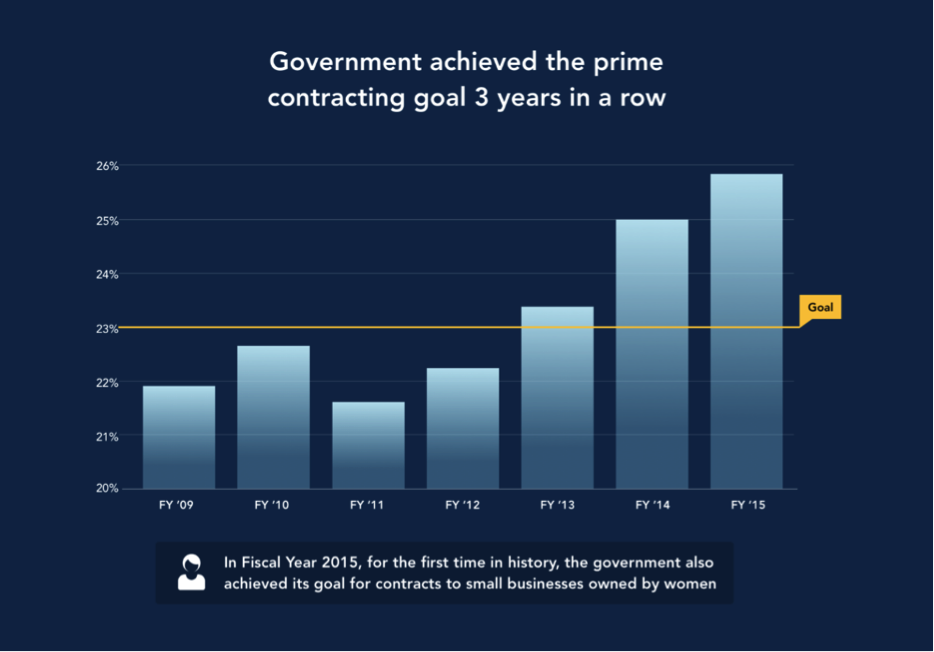

For the past three fiscal years in a row, the federal government has met or exceeded its statutory goal of awarding 23 percent of federal contract dollars to small businesses. And last year, the SBA led the government to an all-time high of 25.75 percent.

In FY 2015, 10.06 percent of those contracting dollars, or $35.4 billion, went to small disadvantaged businesses—firms owned by people who face both social and economic disadvantage in society—setting a record and more than doubling the statutory goal.

In partnership with the White House and OMB, the SBA also created the QuickPay Initiative and the Supplier Pay Partnership to strengthen small businesses by increasing their working capital. Launched in 2011, the QuickPay Initiative requires federal agencies to expedite payments to small business contractors, with a goal of 15 days, resulting in more than $1 billion in cost savings for small businesses. The program was expanded to private sector contracting with the launch of SupplierPay.

Closing the gender gap. Women make up half the population and 40 percent of new entrepreneurs each year, yet they still face too many barriers to economic equality. The SBA is working to level the playing field.

Working to improve the ability of women-owned businesses to compete for federal contracts, the SBA commissioned a study in 2014 that identified 113 new industry groups where women are under-represented. Under federal contracting rules, this allows the federal government to make an additional $39 billion of contracting available to women-owned small businesses. We also rolled out Certify.SBA.gov, a new online platform that helps small businesses apply for contracting certifications, making it easier for women-owned firms to navigate the process of accessing SBA’s federal contracting programs. Our ChallengeHER series has held women’s contracting outreach events across the country, promoting procurement opportunities for women. As a result, the federal government met the 5 percent women-owned small business goal for the first time in history, a landmark achievement that gives me great pride.

The SBA has also worked hard to grow its Women’s Business Center network. Last year alone, these women’s business centers served more than 145,000 entrepreneurs, providing one-on-one counseling, classroom training, networking and other services to help women start and grow businesses.

And recognizing that venture capital funding still goes overwhelmingly to startups run by men, SBA launched InnovateHer, a nationwide competition highlighting women entrepreneurs who have been critical to growing businesses and creating jobs, whether it’s in in cutting-edge fields like precision medicine or cybersecurity through advances in agriculture or manufacturing. This competition drew more than 2,000 participants in contests across the country this year.

Leading the way on diversity in investment. A study SBA commissioned in 2015 with the Library of Congress found that:

- SBA’s SBIC funds are more likely to have women in leadership positions than other private sector companies,

- Diverse investor groups are more likely to invest in companies with diverse representation,

- And, women-managed funds perform as well as their male counterparts.

The agency has also teamed up with a broad range of professional organizations to launch the OnBOARD Initiative, which is designed to present SBIC-funded companies with a steady supply of diverse talent ready to assume board leadership positions in corporate America.

Supporting America’s veterans. America’s veterans are vital to America’s entrepreneurial success, and SBA helps them access federal resources and opportunities.

SBA grew its network of Veterans Business Opportunity Centers, expanding from six regional centers to the current national network of 20 across the U.S. The federal government also saw record achievements in contracting dollars awarded to businesses owned by service-disabled veterans, hitting the goal of sending 3 percent of federal contract dollars to these businesses for an unprecedented four years in a row.

Since 2013, the SBA has trained 50,000 active duty service members and spouses worldwide through our Boots to Business program. In 2014, we launched the first overseas Boots to Business classes for transitioning service members, with more than 14,000 transitioning service members participating in the two-day Introduction to Entrepreneurship course held on more than 200 military installations around the globe. Our “Boots to Business: Reboot” program expanded the entrepreneurship training to veterans who have already transitioned out of the military, as well as members of the National Guard and Reserve.

Improving Support Structures for Entrepreneurs and Catalyzing High-Growth, High-Impact Startups

America must continually strengthen our culture of entrepreneurship: encouraging educated risk taking, fighting for a level playing field for small businesses, and breaking down barriers to entry. We are diligent in seeding innovation, with programs focused on companies with the potential to create game-changing economic breakthroughs.

Building on our record of success with entrepreneurial coaching. The SBA supports the largest network of entrepreneurial counselors in the world. Through our partners at Small Business Development Centers (SBDCs), SCORE volunteer mentors, Women’s Business Centers, Veterans Business Outreach Centers, and district offices, we assist more than one million entrepreneurs each year.

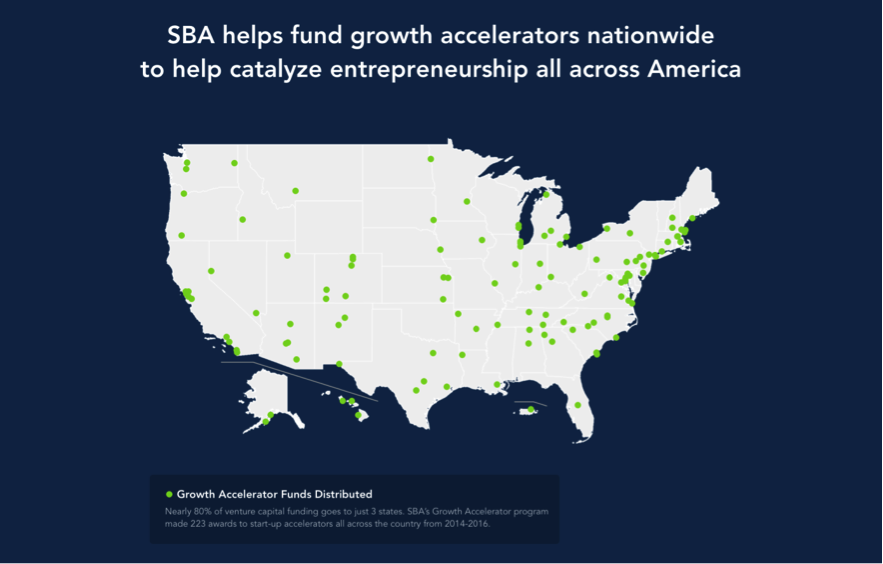

To continue to evolve our services along with the changing face of entrepreneurship, we created our Growth Accelerator Program in 2014 and have invested in more than 200 incubators and innovation hubs. Our first two cohorts included incubators that support 5,000 companies that have raised $1.5 billion and employ nearly 20,000 people. As shown below, these hubs exist all across the country, and are providing new avenues for innovation and job creation.

SBA also invested in increased mobile technology for its staff, enabling them to work directly with aspiring and nascent entrepreneurs in incubators and innovation hubs. And, in partnership with a number of leading technology companies, SBA launched the Small Business Technology Coalition to help small businesses leverage modern technology to compete as the business landscape changes.

Helping small businesses start and scale through targeted training initiatives. In 2010, SBA created the Regional Innovation Clusters program to foster business expansion in regional industries that are poised for growth. A recent study of the program found that entrepreneurs participating in our clusters created jobs four times faster than their local industry peers. They also grew their total payrolls four times faster, while 88 percent said they had been unable to obtain similar services outside of the cluster.

Recognizing that three out of four new jobs in America are created by businesses scaling up rather than starting up, SBA launched the ScaleUp America program. ScaleUp awards contracts to communities to provide free resources for growth-oriented businesses with revenues between $150,000 and $500,000 – such as free management assistance, intensive entrepreneurship education, access to growth capital, and access to networking opportunities. We also grew the Emerging Leaders Initiative, an intensive training program for business owners looking to expand their businesses. SBA has expanded this initiative from 15 locations in 2009 to more than 50 in 2016. More than 4,000 business owners have benefited from the training. Nearly 70 percent of Emerging Leaders graduates achieved revenue growth, and together they have secured federal, state, local and tribal contract awards totaling more than $700 million.

Working with federal partners to support the next generation of high-growth startups. In 2011 President Obama signed a long-term reauthorization of the SBIR and Small Business Technology Transfer (STTR) programs, for the first time in a decade. These programs provide around $2.5 billion in federal R&D funding to technology startups and other small businesses. SBA and 11 participating federal agencies have expanded access to SBIR/STTR opportunities with a new SBIR.gov platform and a road tour that engaged rural communities across the country. Since 2009, these programs provided more than $14.7 billion to nearly 19,000 innovative small businesses. According to one study, every $1 million in funding created more than 40 jobs.

Reducing red tape for entrepreneurs. In 2015, SBA launched the Startup in a Day initiative. To date, more than 100 cities have pledged to streamline their business startup process, allowing local entrepreneurs to navigate requirements in as little as 24 hours. We funded two competitions to promote the development of online tools that support this goal. The city of Los Angeles won the top prize with an open-source tool that is now available at business.lacity.org.

Broadening Access to Global Markets through Exporting

Ninety-five percent of the world’s consumers live outside the U.S., yet only 1 percent of America’s small businesses export. The SBA is working to change that. We’ve made great progress in expanding access to export financing and counseling through a newly established Office of International Trade that oversees 21 export assistance centers across the country, provides export financing, and directs initiatives to encourage trade. This office works to improve ties between Small and Medium Enterprise (SME) sectors across borders.

In 2011, the competitive State Trade Expansion Program (STEP) – a federal-state partnership – was created to advance key priorities identified in the President’s National Export Initiative. STEP has helped to expand the number of small businesses that export by working to make the exporting process as easy as possible for small businesses. In the first three years of the program, small businesses participated in more than 34,000 export activities supported by STEP funds.

To help small businesses navigate the complex road to international trade, our SBDC partners have also vastly increased their resources for international trade assistance. The SBDC program’s number of certified export counseling staff grew from less than 100 in 2010 to more than 650 today.

SBA also worked closely with the State Department and our SBDC network to support the expansion of the Small Business Network of the Americas (SBNA). There are now close to 120 SBDCs operating within the SBNA region, serving approximately 30,000 clients annually.

Since President Obama took office, SBA has supported $8.6 billion in small business export financing. In FY2016, the SBA supported more than 1,800 export loans for a total of nearly $1.5 billion, which in turn supported more than 28,000 U.S. jobs.

In 2015, for the first time ever, the SBA convened Minister-level and high-ranking officials from across the world to exchange best practices and improve small business ecosystems worldwide in a series of annual Global SME Ministerials.

The Future of American Small Business

Small businesses faced a profound struggle as a result of the Great Recession, but thanks to progress made under President Obama, the future looks brighter. The worst challenges faced by small businesses have been overcome, and the dream of becoming a business owner continues to become a reality for more Americans, as women and minorities expand their presence in the entrepreneurial ranks and unlock untapped potential for continuing America’s history as a nation of entrepreneurs.

The basic trends in how small businesses access capital are shifting, as traditional banks have moved away from small business lending and online alternative lenders rise to fill the gap. The “gig economy” is altering the definition of business ownership, as the concept of self-employment takes on new meaning and emerges in new ways. And even as underserved groups make strides, there are indications that young people are starting new businesses less frequently than prior generations. There is an economic imperative that America continues to rebound from a 40-year decline in startup activity.

Small business policy needs to respond to these trends and build on the gains made during the Obama years and continue to ensure that the American dream of owning your own business remains achievable. One of our economy’s greatest strengths is the powerful investment and innovation infrastructure available in places like Silicon Valley, but today much of the U.S. population cannot access similar resources. We would do well to replicate the Silicon Valley model and build a future where more of what makes our country great is available to all communities and in all parts of the country.

Making this vision a reality will require a focus on expansion on the themes the SBA has pursued over the past eight years: seizing technology, engaging the international marketplace, and assuring every aspiring entrepreneur has the requisite resources for success. It will require all of us to continue to rethink how the SBA and the federal government approach the goal of supporting our small firms. The ideas below help point the way forward.

Improving Access to Capital by Modernizing SBA’s Programs

Expanding access to financing. All forms of capital are not created equal; some are more beneficial to a small business owner than others. Two types in particular deserve focus in the future: equity and revolving credit lines. Today, outside of a few innovation hubs concentrated in a few geographies, there is not enough equity capital available to American entrepreneurs. Equity crowdfunding, which became available thanks to the passage of the JOBS Act under President Obama, is one way to combat this challenge. The SBA has a potential role to play here, both in catalyzing increased access to capital and ensuring that small businesses have a full understanding of the various types of capital and the risks associated with each. Revolving lines of credit, meanwhile, offer a means out of the short-term financing trap that small businesses, especially those with less experience or stability, may be prone to. The next Administration should work to ensure that no business owner is forced to choose a high-interest rate loan because SBA financing would take too long to obtain. While our technology investments have been significant and dramatically streamlined our processing times, it still can take too long. We can do better and we must.

Growing the pool of SBA lenders. Loans backed by SBA are a particularly beneficial form of capital. By helping to alleviate both real and perceived risks, these loans encourage economic activity and the benefits that come from the risk-taking endeavor we call entrepreneurship. Yet today, a majority of American banks and credit unions choose not to make these loans at all. The next Administration should broaden our lender education campaign about the recent system upgrades. The SBA must also work with bank regulators to restore the two-tier banking system. As a result of the downturn, there is now a dearth of independently-owned banks, especially in underserved communities. Community banks have typically been the non-formulaic (character-based lenders) in local communities. For a more viable community-based system, the next Congress should consider legislation to ease overly burdensome regulations. The push to recruit new lenders to collaborate with the SBA should be continued by the next Administration as it has over the last several years, and it should include a sustained effort to promote SBA’s products, a constant effort to simplify the programs, and persistent engagement with the lending community to identify opportunities for making them more competitive, just as this administration has done. In time, it may also make sense for the next Administration to bring alternative online lenders into the SBA fold as well, provided they are willing to meet the agency’s standards.

Expanding small dollar lending. One consequence of the financial crisis was the movement of banks away from lending at small dollar levels, where risks may be higher and profits lower. Loans at this level are critical to nascent businesses. The next Administration should continue to support the SBA’s efforts to expand small dollar lending, through an expansion of microlending and through policies such as reduced collateral requirements, cutting red tape, and lowering fees for smaller dollar loans.

Expanding Opportunities for Entrepreneurs from Every Corner of our Nation

Knocking down the barriers to government contracts. The hurdles to becoming a successful federal contractor too frequently overwhelm small businesses. While SBA has significantly streamlined its certification processes, even more could be done if the next Congress would consider statutory changes. For instance, legislation to raise the dollar limit on contracts awarded under the “simplified acquisition threshold” from $150,000 to $500,000 should be considered, as the Obama Administration has recommended. Progress has been made to attract more small firms to the federal marketplace and the corporate supply chain with programs announced during the Obama Administration incentivizing prompt payment to small firms. SBA has also lowered barriers to entry – including improvements to the contractor registration and easing the process for conducting business on the GSA Schedules. However, simplification opportunities remain so that agencies can more effectively leverage the talents of small businesses to get better value from their contracts.

Engaging with communities. The agency must reimagine its physical presence and the way it interacts with entrepreneurs. Today the SBA funds a nationwide network of startup accelerators, and has begun to co-locate our staff with them.

The next Administration should continue efforts like this to push federal service offerings out of the four walls of government buildings and into the communities where entrepreneurs actually are, from community centers to libraries to co-working spaces. The federal government must also continue to innovate on the way it delivers counseling and training, seeking new ways to deliver services to aspiring entrepreneurs. Through greater work to promote language skills, cultural competencies and deep connections with underserved communities from those who deliver these services, we can continue to ensure entrepreneurship is accessible to all.

Improving Support Structures for Entrepreneurs and Catalyzing High-Growth, High-Impact Startups

Reducing regulatory burdens and making rules consistent. The complexity of government rules on starting and running businesses can be a drag on entrepreneurship, stopping would-be business owners in their tracks or slowing them down enough to hinder success. In many cases, these burdens are the product of local, county, and state laws, not federal policy. To help, the next Administration should build upon SBA’s Startup in a Day Initiative, engaging more mayors nationwide who are committed to making it easier for entrepreneurs to start ventures in their own communities. A designated task force could review available technologies and provide model examples. Beyond just using its convening power to help drive this analysis, the next Administration should also consider continuing to encourage streamlining efforts through grants and funding competitions.

Bringing more services online. Technology is one of the great leveling forces in the economy. It can make services and information available to anyone, anywhere, regardless of their social, educational, or financial capital. The next Administration should consider expanding the agency’s online learning offerings, which could allow the government to deliver high-caliber tools, training, and resources, all free to any would-be entrepreneur.

I encourage the next Administration to continue making online matchmaking between borrowers and lenders a priority as the FinTech market improves along with it, allowing borrowers to find lower-interest government-guaranteed loans with the same speed with which they can find higher-interest products from alternative lenders.

Need for better data. Good small business policy cannot be made without good data. Per the President’s directive, SBA increased the availability of high-quality government data to the public. The Census Bureau has also partnered with the Kauffman Foundation to release more current survey data on the demographics and performance of small business owners. The Dodd-Frank Act empowered the Consumer Financial Protection Bureau to collect detailed data about small business lending. The next Administration should continue to invest in new data collection and data sharing, to ensure high-quality, detailed data.

Conclusion

The SBA is committed to making a difference for millions of entrepreneurs in every corner of our nation. I could not be prouder of the unparalleled efforts by our entire SBA team in communities across the country. At record lending, record investments, and record contracting levels, SBA has never performed better. It has been the honor of a lifetime to work alongside the extended SBA family to support America’s small businesses. Together, we redoubled our efforts to be smart, bold, and accessible – building smarter systems, enabling bold expansion into new markets, and ensuring the path to business ownership is accessible to all Americans.

We moved more services online as the public has shifted away from a brick-and-mortar world. We created a new Office of Investment and Innovation to align the SBA with a rising startup economy. We established an Office of International Trade to help small business owners access the global marketplace. We challenged our team to move out of federal offices and work more closely with the communities we serve.

Whether supporting small business contractors as they bid on federal procurements or financing small businesses as they expand internationally, the SBA’s mission is to encourage and support small businesses as they seek out new markets.

SBA’s services must remain accessible to all. If any community is underrepresented in the agency’s work, the next Administration should rethink and retool our programs to ensure widespread access. If investment is concentrated in a handful of counties, the next Administration should increase services and incentives in cities and towns that the market overlooks.

Small businesses are the prime drivers of American job creation, and small business owners form the backbone of our nation’s communities. Our tradition of entrepreneurship continues to attract innovators and risk takers to our shores. To maintain the vitality of our small business ecosystem, the next Administration must be as nimble and innovative as the entrepreneurs it serves. By supporting them, we ensure the American Dream remains alive for future generations.