Thank You

For your submission

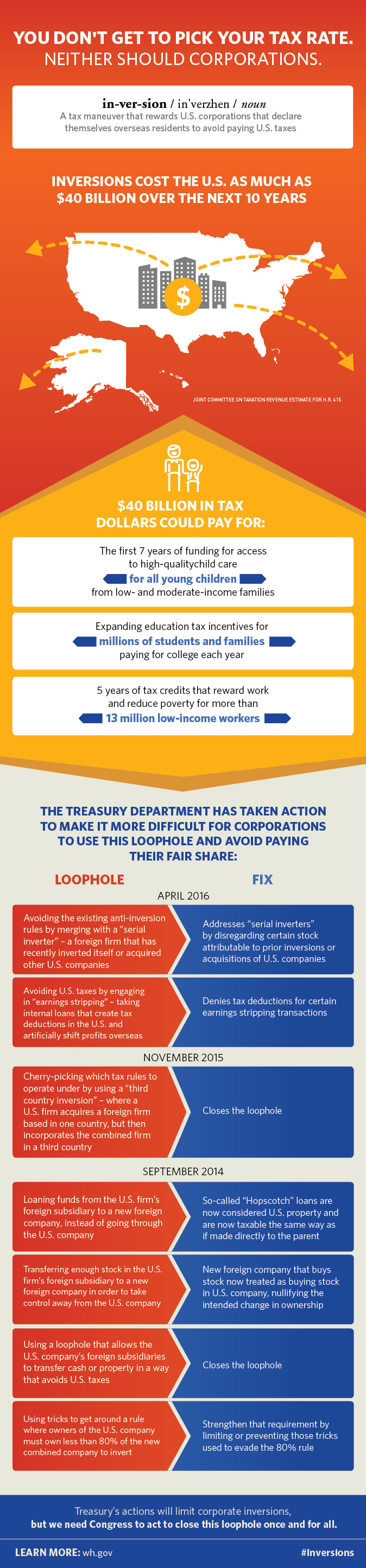

You Don't Get to Pick Your Tax Rate. Neither Should Corporations.

Inversions -- or tax maneuvers that reward U.S. corporations that declare themselves overseas residents to avoid paying taxes in America -- have drawn the ire of many Americans as an example of an unfair corporate tax loophole. The Treasury Department took another step to limit inversions. Get the facts below, and then pass this on.

Here's the bottom line: When large corporations invert overseas to reduce the taxes they paid in the United States, working Americans ultimately have to pay more to help fund the services we all rely on. (Like rebuilding our roads and bridges, equipping our schools with the resources they need, and defending our country at home, to name a few.) Working Americans can’t move their tax residence overseas on paper to avoid taxes, and American corporations shouldn't be able to either. Ultimately, however, Congressional action is needed to fully address inversions. If you learned something new here, don't let the information stop with you. Pass this on.