EDUCATION

“If we want America to lead in the 21st century, nothing is more important than giving everyone the best education possible — from the day they start preschool to the day they start their career.”

Making College Affordable

"We will provide the support necessary for you to complete college and meet a new goal: by 2020, America will once again have the highest proportion of college graduates in the world."

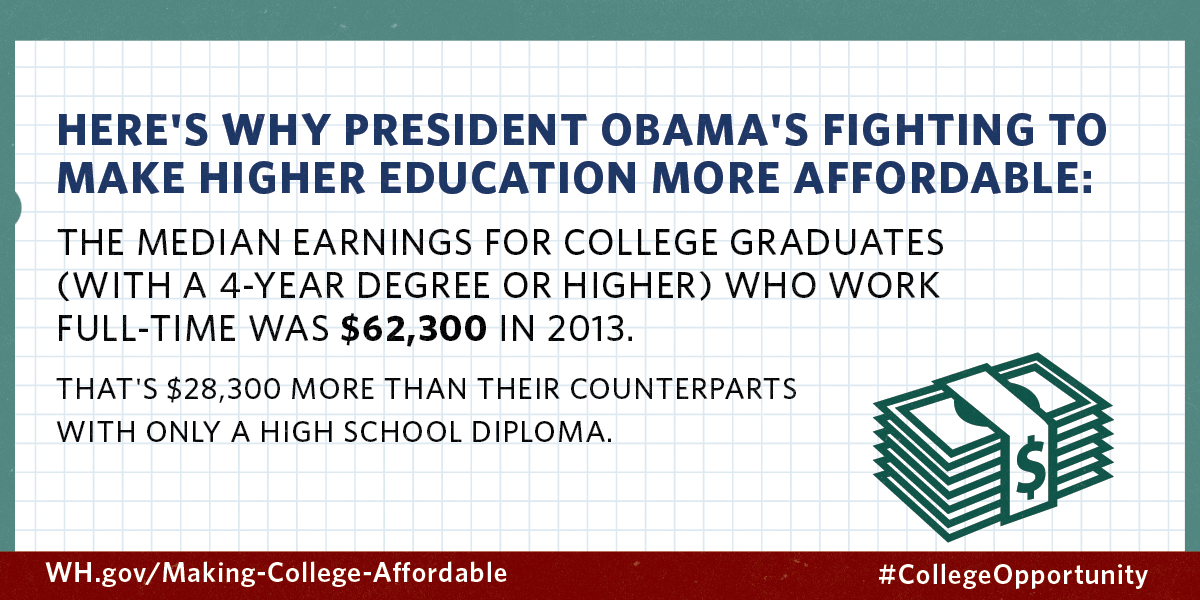

Higher education is the single-most important investment that Americans can make in their futures, increasing their future potential earnings and lowering their risk of unemployment. Despite these benefits, the cost of attaining this education has skyrocketed over the past few decades, putting college out of reach for too many low- and middle-income families.

Over the past three decades, the average tuition at a public four-year college has more than a tripled, while a typical family’s income has barely budged.

As a result, more students than ever before are relying on student loans to pay for their college education. Today, 71 percent of students earning a bachelor’s degree graduate with debt, which averages $29,400. While most students are able to repay their loans, many feel burdened by debt, especially as they seek to start a family, buy a home, launch a business, or save for retirement.

The President and his administration have a long track record of taking steps to make college more affordable and accessible for families. And as part of his year of action to expand opportunity for all Americans, the President is committed to building on these efforts by using his pen and his phone to make student debt more affordable and manageable to repay.

On June 9, 2014, President signed a new Presidential Memorandum directing the Secretary of Education to propose regulations that would allow an additional nearly 5 million federal direct student loan borrowers the opportunity to cap their student loan payments at 10 percent of their income. The memorandum also outlines a series of new executive actions aimed to support federal student loan borrowers, especially vulnerable borrowers who may be at greater risk of defaulting on their loans.

Learn about your current loan repayment options

For current federal student loan borrowers: Before you contact your loan servicer to discuss repayment plans, you can use the calculator below to get an early look at which plans you may be eligible for and see estimates for how much you would pay monthly and overall. The President’s recently announced expansion of PAYE to all Direct Loan student borrowers will be added to this calculator once it has been implemented.

If you would like to view estimates based on your actual federal student loan information, please use the Repayment Estimator on studentloans.gov and click the link to sign in.

Spread the word

See what else the President has done

Over the course of his administration, President Obama has worked tirelessly to make college more accessible, affordable, and attainable for all American families. Here are some examples:

Increasing Pell Grant awards

The President has raised the maximum Pell Grant award to $5,730 for the 2014-15 award year — a nearly $1,000 increase since 2008. Under the President’s leadership, the number of Pell Grant recipients has expanded by 50 percent over that same time, providing college access to millions of additional low-income and middle-class students across the country. The Obama Administration’s landmark investment in the Pell Grant was enacted in the Health Care and Education Reconciliation Act of 2010, which ended student loan subsidies for private financial institutions and banks and shifted over $60 billion in savings back to students.

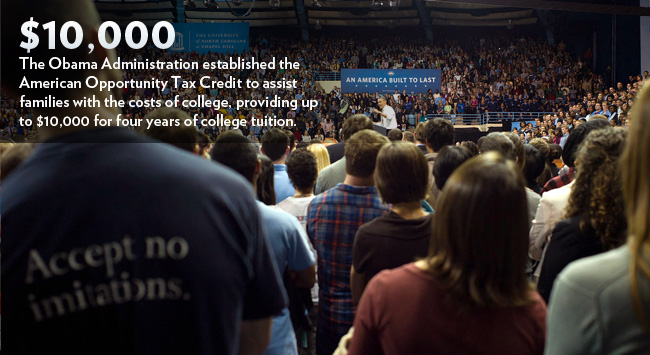

New tax credits to help families pay for college

President Obama established the American Opportunity Tax Credit in 2009 to assist families with the costs of college, providing up to $10,000 for four years of college tuition for families earning up to $180,000. 11.5 million families are expected to now benefit from the American Opportunity Tax Credit.

Reforming student loan programs to increase college aid

The education-related initiatives funded by the Health Care and Education Reconciliation Act are fully paid for by ending the government subsidies currently given to financial institutions that make guaranteed federal student loans. Starting July 1, all new federal student loans will be direct loans, delivered and collected by private companies under performance-based contracts with the Department of Education. According to the non-partisan Congressional Budget Office, ending these wasteful subsidies will free up nearly $68 billion for college affordability and deficit reduction over the next 11 years.

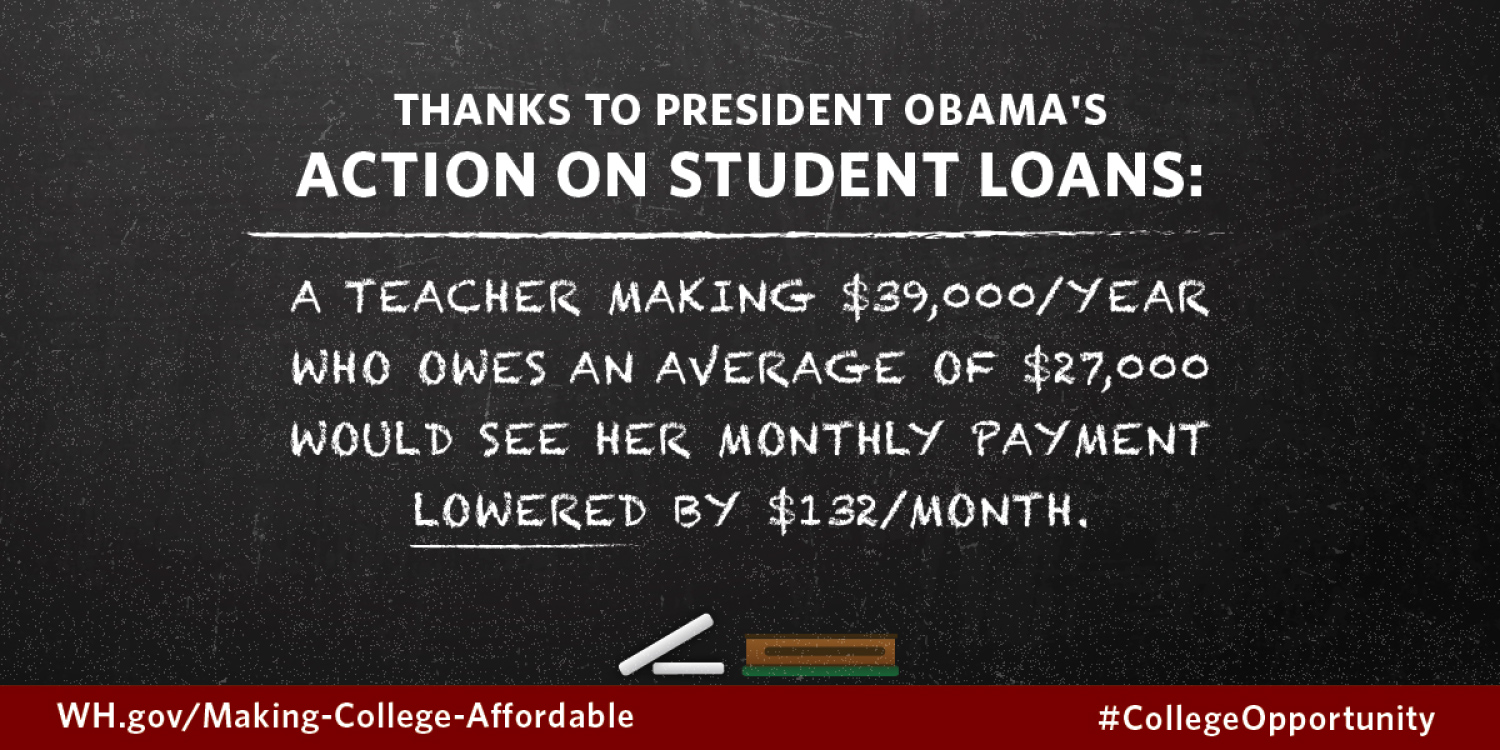

Expanding Income-Based Repayment

The Administration’s “Pay as You Earn” plan expanded income-based repayment to enable students to take advantage of a new option to cap repayment of student loans at 10 percent of monthly income. These changes reduced the burden of student loans in a fiscally responsible way. Additionally, millions of borrowers are now eligible to consolidate Direct Loans and FFEL Loans and save up to half a percentage point on their interest rate.

Visit our Higher Education page to see what else the President has done so far.