Third-quarter economic growth was revised upward as domestic demand continued to grow at a solid pace. Slowing foreign demand continues to weigh on overall growth, underscoring the importance of policies that promote strong and consistent domestic demand instead of unnecessary austerity and fiscal brinksmanship. That’s why Congress needs to finish its business this year: passing a complete budget that builds on last month’s bipartisan budget agreement, increasing investments in surface transportation infrastructure, and reauthorizing the Export-Import Bank.

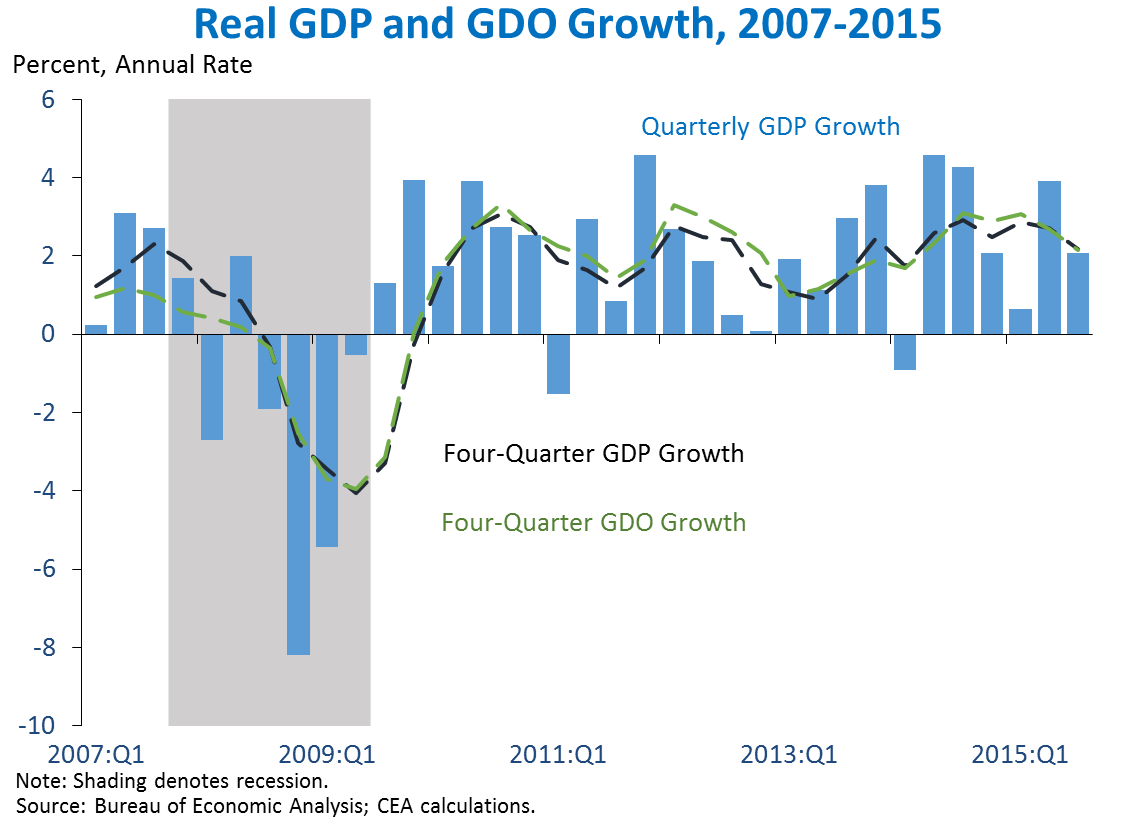

1. Real Gross Domestic Product (GDP) rose 2.1 percent at an annual rate in the third quarter, according to BEA’s second estimate. In the third quarter, GDP grew at a faster pace than originally estimated, but at a slower pace than the 3.9 percent rate in the second quarter. Third-quarter GDP growth was boosted by consumer spending (which rose 3.0 percent), business fixed investment (which rose 2.4 percent) and residential investment (which rose 7.3 percent). However, inventory investment—one of the most volatile components of economic output—subtracted 0.6 percentage point from overall growth. Net exports continued to weigh on output, subtracting 0.2 percentage point amid slowing global demand. Export growth remains well below the pace observed earlier in the recovery. Overall, real GDP rose 2.2 percent over the past four quarters.

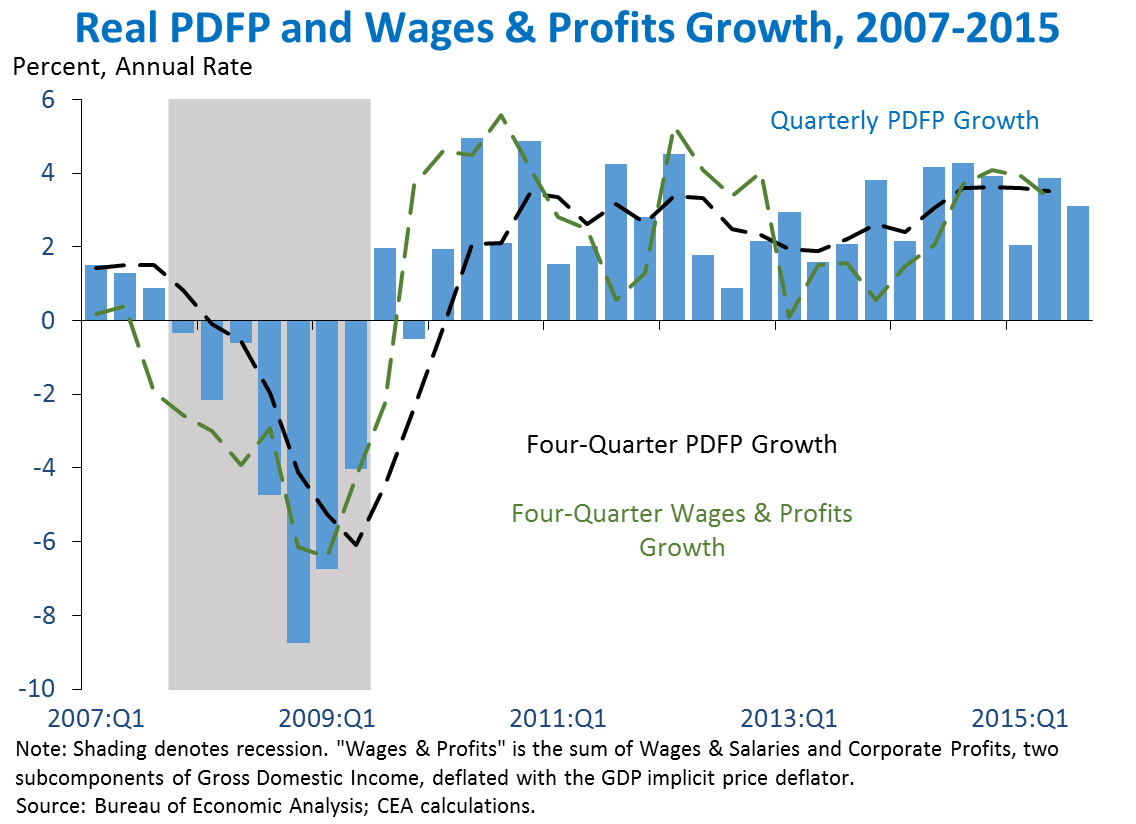

Real Gross Domestic Output (GDO)—the average of product-side and income-side measures of output—rose 2.6 percent in the third quarter, a faster pace than GDP alone. But in the second quarter—including upward revisions to wages and salaries—GDO is now estimated to have grown 3.0 percent at an annual rate, somewhat slower than GDP. CEA research suggests that GDO is potentially more accurate than GDP (though not typically stronger or weaker) over the long term. GDO is estimated to have grown 2.2 percent over the past four quarters, the same pace as GDP.

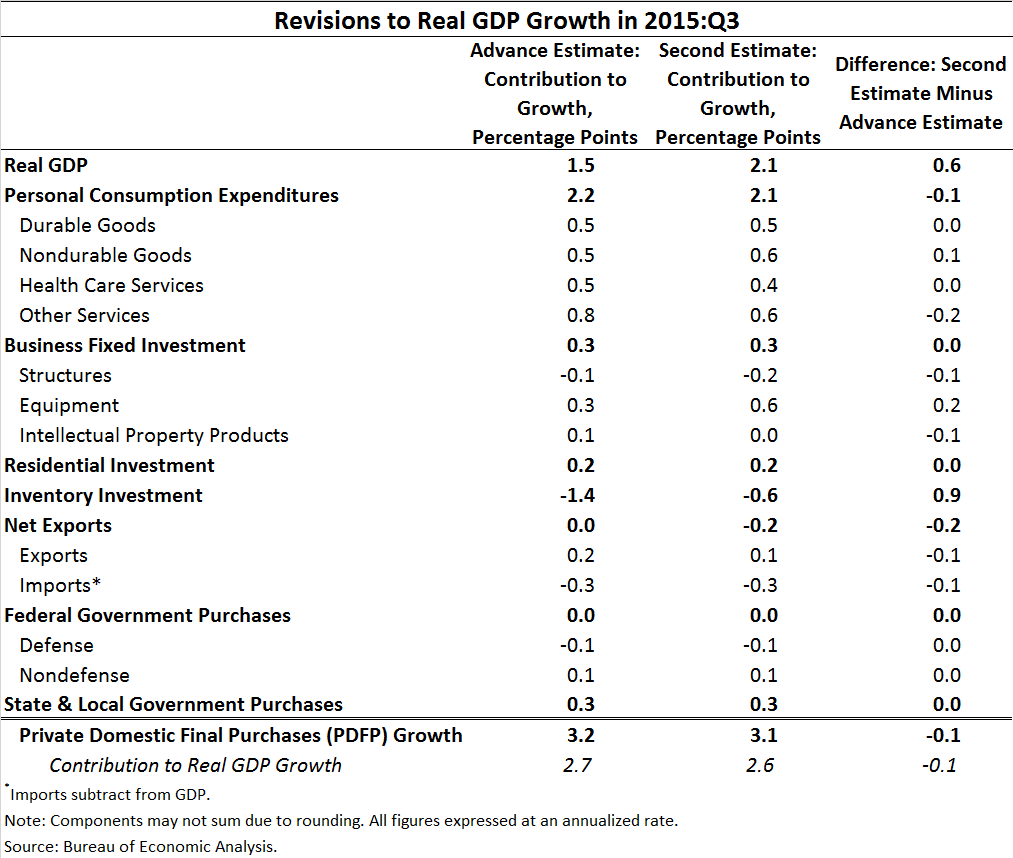

2. Third-quarter real GDP growth was revised up 0.6 percentage point at an annual rate. The upward revision was more than accounted for by a smaller decline in inventory investment than initially estimated, contributing 0.9 percentage point to the GDP growth revision. A modest downward revision to net exports partially offset that shift, reflecting both lower exports and higher imports than previously estimated. Services consumption growth was also revised down slightly. On balance, these revisions tend to move third-quarter growth more in line with longer-term trends, with net exports weighing on growth and inventories having a smaller impact.

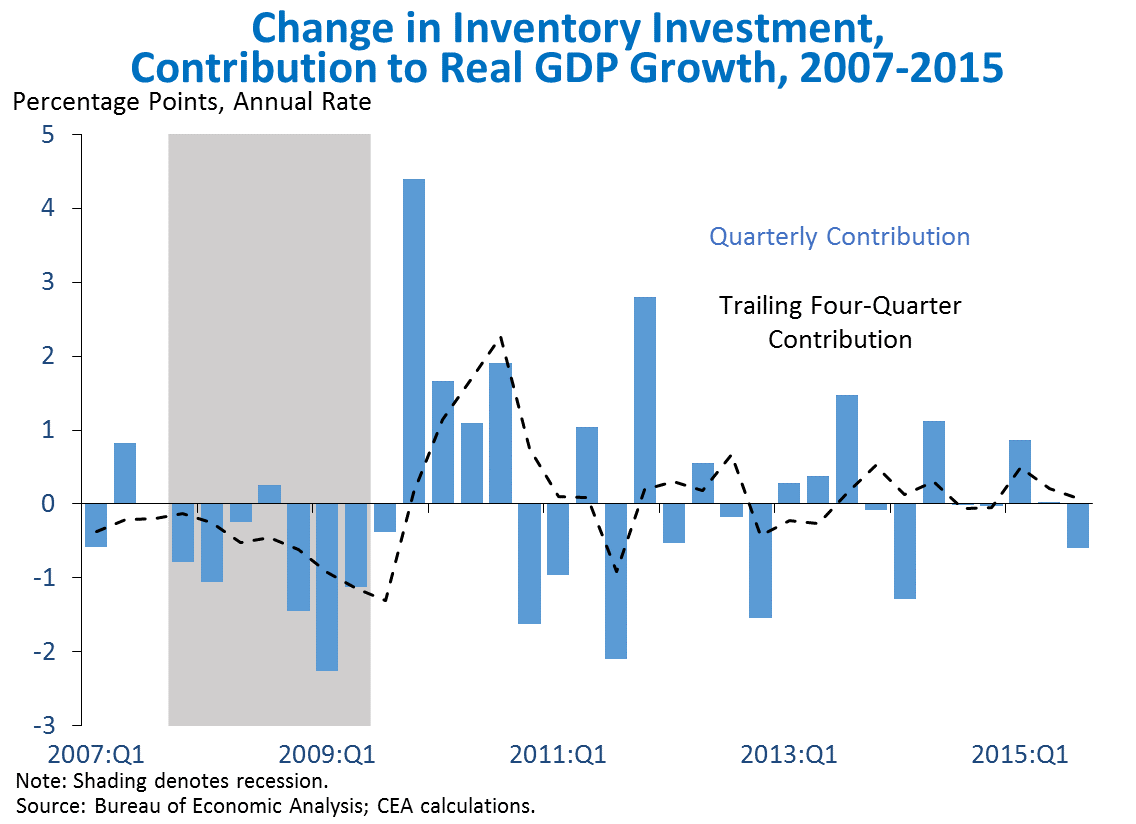

3. Changes in inventory investment, including the third-quarter decline, tell us little about underlying growth trends. The change in inventory investment is an especially volatile component of economic output, frequently adding or subtracting a full percentage point or more from annualized GDP growth in a given quarter. But over longer time periods, quarterly fluctuations in inventory investment tend to cancel one another out and have little impact on long-term growth. For example, although changes in inventory investment subtracted 0.6 percentage point from growth in the third quarter, they have had a negligible impact on average growth over the past year.

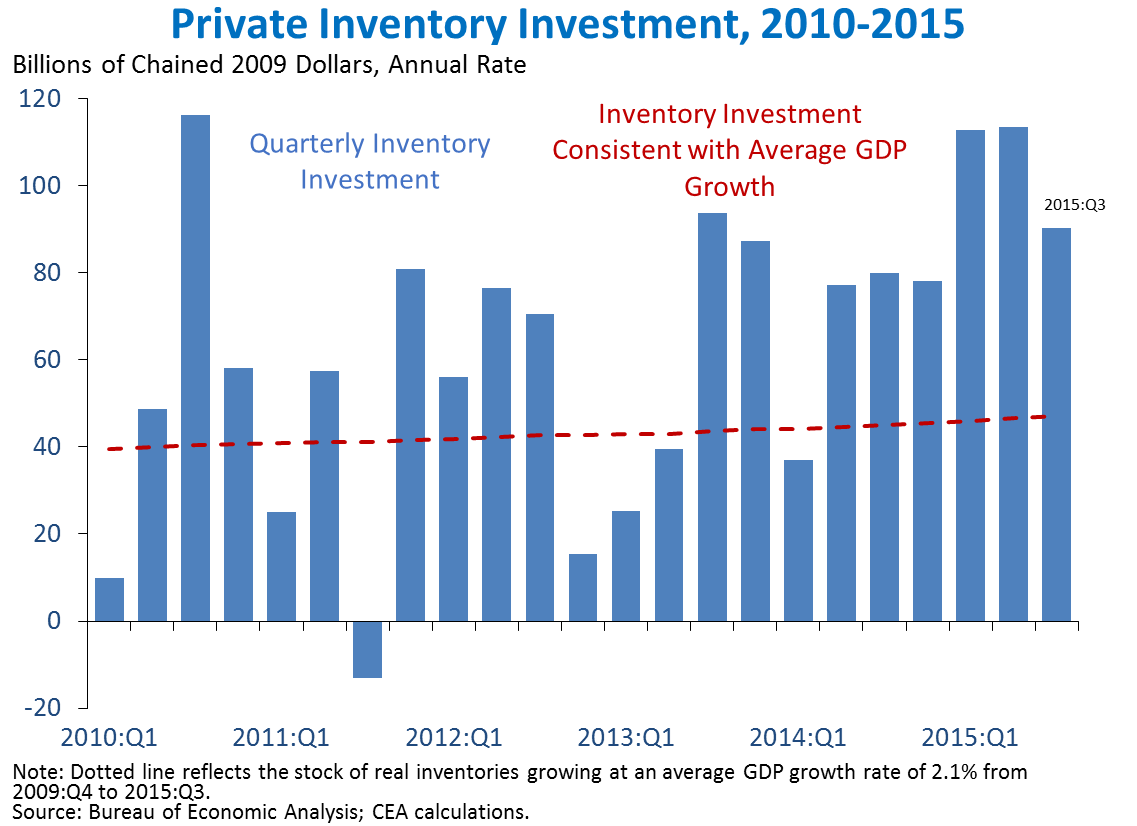

If the economy grows at its post-crisis trend of 2.1 percent per year, inventories would need to grow by about $50 billion per year to keep pace with overall sales. Inventory investment has been above that level lately, consistent with a rising inventory-sales ratio. Inventory investment did grow less quickly in the third quarter, but the pace of investment remains well above the $50 billion pace consistent with a stable inventory-sales ratio and average GDP growth. Especially when considering the recent high level of inventory investment, there is further scope for declines in inventory investment in the coming quarters.

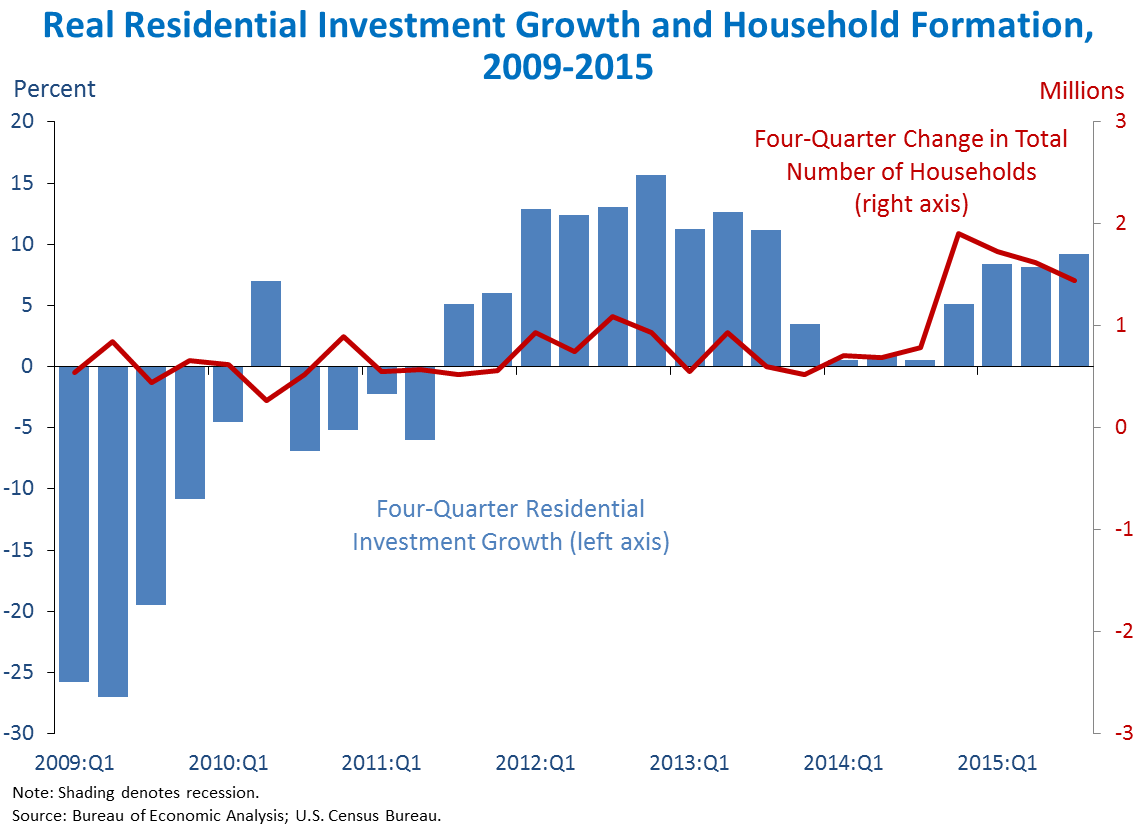

4. Residential investment growth has picked up over the past year. Over the past four quarters, residential investment has grown 9.2 percent—the strongest four-quarter growth rate since the bounce-back from the financial crisis in 2012 and 2013. One encouraging sign for residential investment is household formation, which includes young adults moving into their own residence. Formation has grown sharply during the past year, providing scope for increasing residential investment. Housing demand is expected to continue to strengthen as household formation rises, credit availability improves, and the labor market continues to strengthen.

One important structural challenge facing the supply of housing is the rise in excessive or unnecessary land use regulations. While land use regulations sometimes serve reasonable and legitimate purposes, they can also give extra-normal returns to entrenched interests at the expense of others. I recently discussed these trends—and their links to both aggregate growth and rising inequality—at the Urban Institute.

5. Real private domestic final purchases (PDFP)—the sum of consumption and fixed investment—rose 3.1 percent at an annual rate in the third quarter and is growing at a faster four-quarter pace than overall GDP. Real PDFP—which excludes noisier components like net exports, inventories, and government spending—is generally a more reliable indicator of next-quarter GDP growth than current GDP. To the extent that systematic patterns emerge in global growth, however, the information contained in exports may contain an important signal about the headwinds we face from abroad. Overall, PDFP rose 3.2 percent over the past four quarters, compared with 2.2 percent GDP growth over the same period. The especially large gap between PDFP growth and GDP growth is largely attributable to net exports, reflecting slowing growth abroad.

As the Administration stresses every quarter, GDP figures can be volatile and are subject to substantial revision. Therefore, it is important not to read too much into any single report, and it is informative to consider each report in the context of other data that are becoming available.