Today’s report from the Census Bureau shows that real median income rose in 2014 for both family households (e.g., related people living together) and non-family households (e.g., a single person living alone). Overall median household income declined as the share of family households decreased. The official poverty rate held steady in 2014, while the supplemental poverty rate—which includes the effects of key anti-poverty policies—declined. Over the past two years, the child poverty rate has declined more than in any two-year period since 2000. The fraction of the population without health insurance declined sharply as the Affordable Care Act’s major coverage provisions took effect, falling in all fifty states in 2014. Continued employment and wage growth so far this year suggests that incomes are rising in 2015. The Earned Income Tax Credit (EITC) and other policies have contributed to recent improvements in incomes, and the President’s commitments to extending refundable tax credits enacted under the Recovery Act and implementing an EITC for childless workers will further strengthen these positive trends.

FIVE KEY POINTS IN TODAY’S REPORT FROM THE CENSUS BUREAU

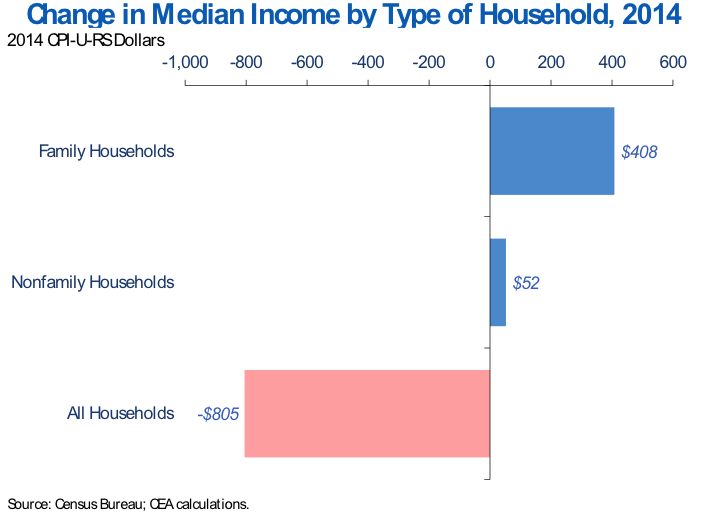

1. Real median income for family households rose $408 in 2014, while real median income for non-family households also rose but overall median household income declined. All households are considered either “family households” (those with persons related by birth, marriage, or adoption) or “non-family households,” and median income for both these groups rose in 2014. At the same time, overall median household income fell as the number of family households (who have a relatively high median income of $68,000) fell and the number of non-family households (who have a relatively low median income of $32,000) surged. Fuller analysis is needed to understand the dynamics between family and non-family households and the implications for income comparisons.

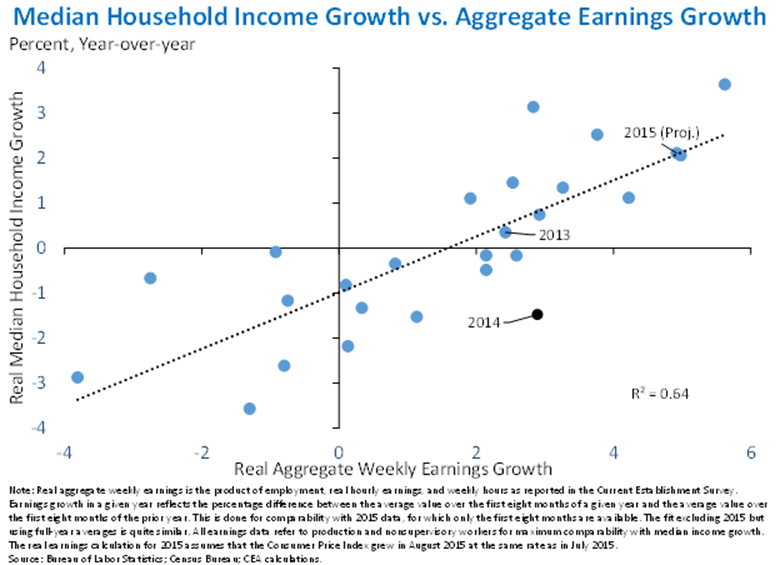

2. Median household income growth tends to follow aggregate weekly earnings growth—which would suggest strong income growth in 2015. Aggregate weekly earnings reflects the total amount earned by private sector workers—the product of employment, hours worked per week, and wages earned per hour. Accordingly, aggregate earnings are conceptually linked more closely to household income than to wages, since both income and aggregate earnings reflect the influence of rising employment as well as rising wages. The below chart shows that median household income growth has been closely related to growth in aggregate weekly earnings in recent decades—with an unusually large disconnect between the two measures in 2014. Aggregate weekly earnings growth in 2014 implied a 1.0 percent increase in real median household income—as compared to the 1.5 percent decrease that was realized. The reasons for the disconnect are unclear, although it could reflect the changing composition of family and non-family households against a backdrop of rising household formation (see point 1). Aggregate earnings in 2015 so far have grown much faster than last year as the long-term trend of labor market improvement has persistent. The historical relationship implies strong median household income growth in 2015 when the data become available next year.

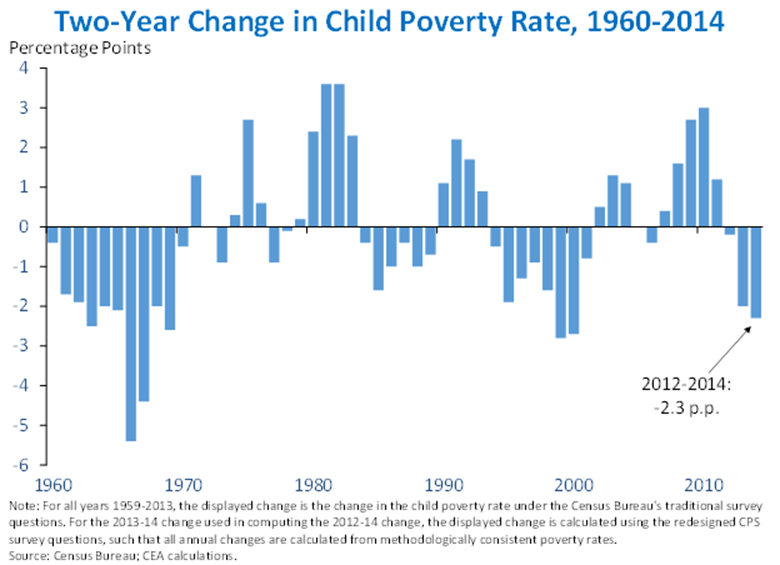

3. Over the past two years, the child poverty rate declined more than in any two-year period since 2000. The child poverty rate declined 1.9 percentage points in 2013 and 0.4 percentage point in 2014. The overall official poverty rate was unchanged in 2014. But when using the supplemental poverty measure—an alternative poverty gauge that reflects the impact of key anti-poverty policies—overall poverty declined from 15.8 percent to 15.3 percent in 2014. The child poverty rate also declined under the supplemental poverty measure in 2014, by a full 1.4 percentage points from 18.1 percent to 16.7 percent.

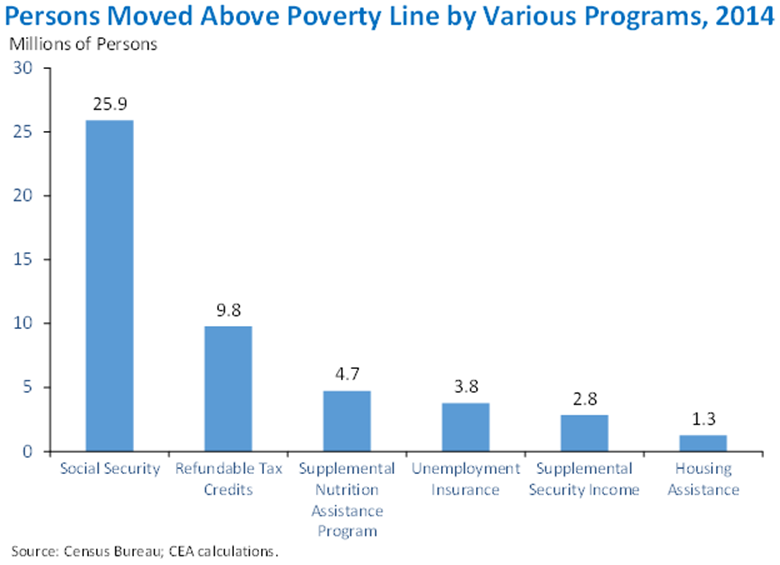

4. The supplemental poverty measure (SPM), which declined 0.5 percentage point in 2014, includes the direct effects of key anti-poverty policies like the Earned Income Tax Credit (EITC) and the Supplemental Nutrition Assistance Program (SNAP). The SPM is widely acknowledged to measure poverty more accurately than the official measure. Unlike the official measure, the SPM uses a post-tax and post-transfer concept of resources that combines earnings with assistance from government programs, including cash transfers and the cash-equivalent of in-kind transfers like food assistance—minus net tax liabilities, which can be negative for families receiving refundable tax credits like the EITC or Child Tax Credit (CTC), and necessary expenditures on work, child care, and health care. Together, 9.8 million Americans are above the poverty line who would fall below it but for refundable tax credits, and other programs account for similar totals. Social Security (whose benefits are also included in the official poverty measure) accounts for 25.9 million people who would otherwise fall below the poverty line. The President supports continuing these trends by extending the refundable tax credits enacted under the Recovery Act and implementing an EITC for childless workers.

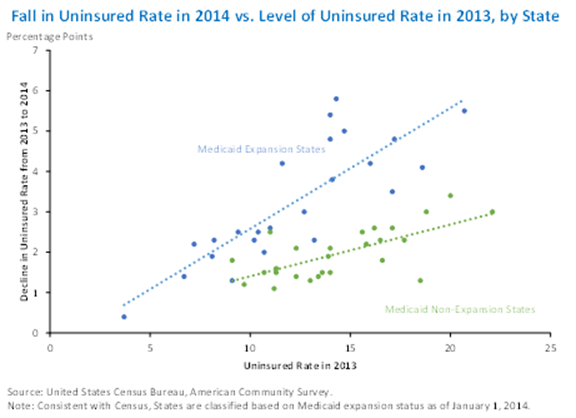

5. The share of people without health insurance coverage declined in every single state in the country in 2014—for the first time in the history of the series—as the Affordable Care Act’s major coverage provisions took effect. The new American Community Survey (ACS) data show that all states saw coverage gains in 2014, but the magnitude of those gains varied widely by state. Notably, states that expanded Medicaid under the Affordable Care Act saw a 3.4 percentage point decline in their uninsured rate, about 1.5 times as large as the 2.3 percentage point decline in states that did not expand the program. The causal effect of Medicaid expansion on state uninsured rates is likely even larger since non-expansion states had higher uninsured rates prior to 2014, and states with more uninsured tended to see larger coverage gains during 2014. Although the ACS is not the first survey to report estimates of state-level trends in insurance coverage in 2014 and beyond, the survey’s extremely large size allows it to provide particularly precise estimates.

Today’s Census release also included estimates of the national change in the uninsured rate based on the Current Population Survey (CPS). According to the CPS, the national uninsured rate dropped by 2.9 percentage points from 13.3 percent in 2013 to 10.4 percent in 2014, broadly consistent with findings from earlier Federal and private surveys for that time period. These other surveys have found that rapid progress in reducing the uninsured rate has continued during 2015, with further declines in the uninsured rate of at least 2 percentage points as of early 2015. Following these sustained declines, the uninsured rate is now at its lowest level ever.

Jason Furman is Chairman of the Council of Economic Advisers. Sandra Black is a Member of the Council of Economic Advisers. Matt Fiedler is Chief Economist of the Council of Economic Advisers.