Economists have traditionally argued that anti-poverty policy faces a “great tradeoff”—famously articulated by Arthur Okun—between equity and efficiency. Yet, recent work suggests that Okun’s famous tradeoff may be far smaller in practice than traditionally believed and in many cases precisely the opposite could be the case. As discussed by one of us in today’s New York Times, recent economic research, much of it using large, high-quality administrative data, shows that key income support, education, housing, health care, and nutritional assistance programs improve health outcomes, educational attainment, employment, and earnings in adulthood for individuals who received this support in childhood. This research suggests that the investments in nutrition assistance, health care, housing vouchers and other programs included in the President’s Budget would not only help low-income families today, but would also improve our future economic performance.

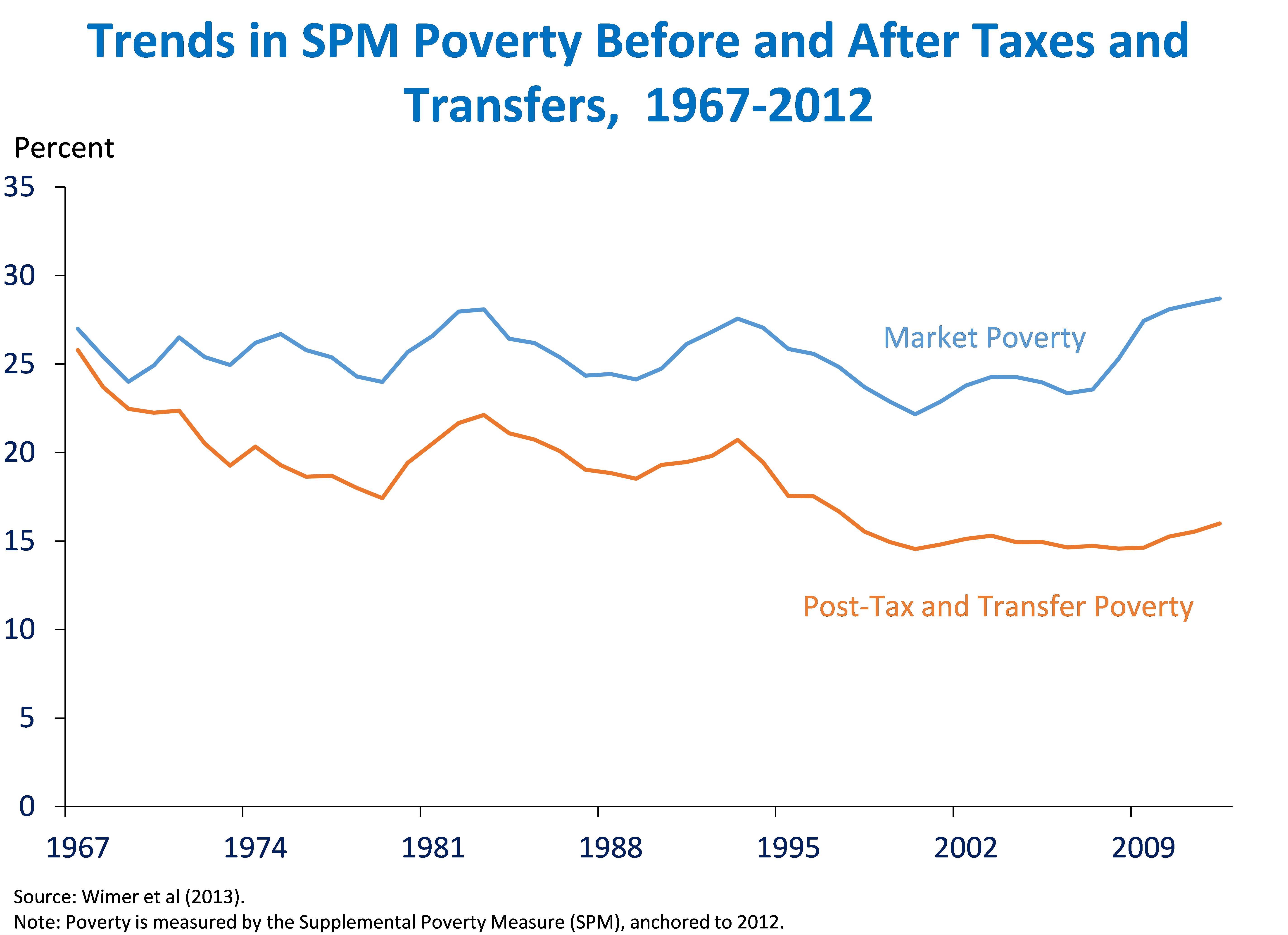

In the half century since President Lyndon B. Johnson declared an unconditional War on Poverty, the Federal Government has invested in strategies that aim to relieve and prevent poverty. Partly as a result of these programs, and a large number of additions and reforms since then, between 1967 and 2012, poverty measured by a measure that accounts for tax and transfer payments fell 9.8 percentage points, or 38 percent. In 2013, income and nutrition assistance programs lifted 46 million people, including 10 million children, out of the poverty. Medicaid has also resulted in better health care for tens of millions of Americans. Another 16 million people have gained coverage following the Affordable Care Act’s coverage expansions, as of early 2015.

Innovative economic research is increasingly finding that these programs have long-run benefits for the children in families that receive them. These studies often drawn upon large “administrative” data sets that are collected in the process of running government programs. These data sources frequently allow researchers to track families over long periods of time with limited attrition, offer much larger sample sizes, and suffer from less missing data than major household surveys. These improvements in data quality have coincided with a “credibility revolution” in economics that has greatly expanded the use of randomized trials and “quasi-experimental” research designs that exploit natural experiments to estimate the causal impact of the programs.

The following is a selection of research in this area for five major current programs—early education, the Earned Income Tax Credit (EITC), Supplemental Nutrition Assistance (SNAP), housing vouchers, and Medicaid—plus one historical income support program.

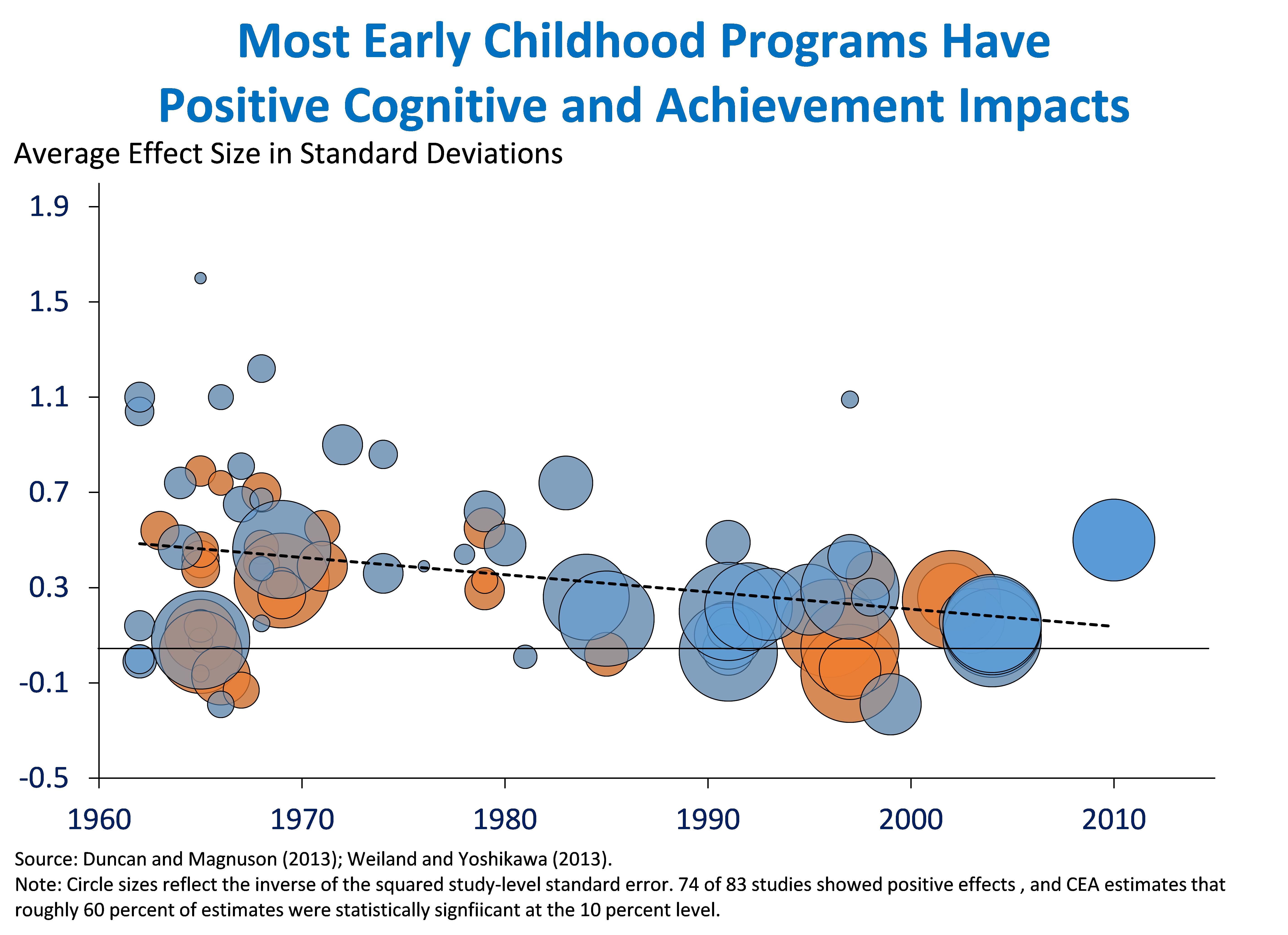

1. Early childhood education programs increase earnings and educational attainment.

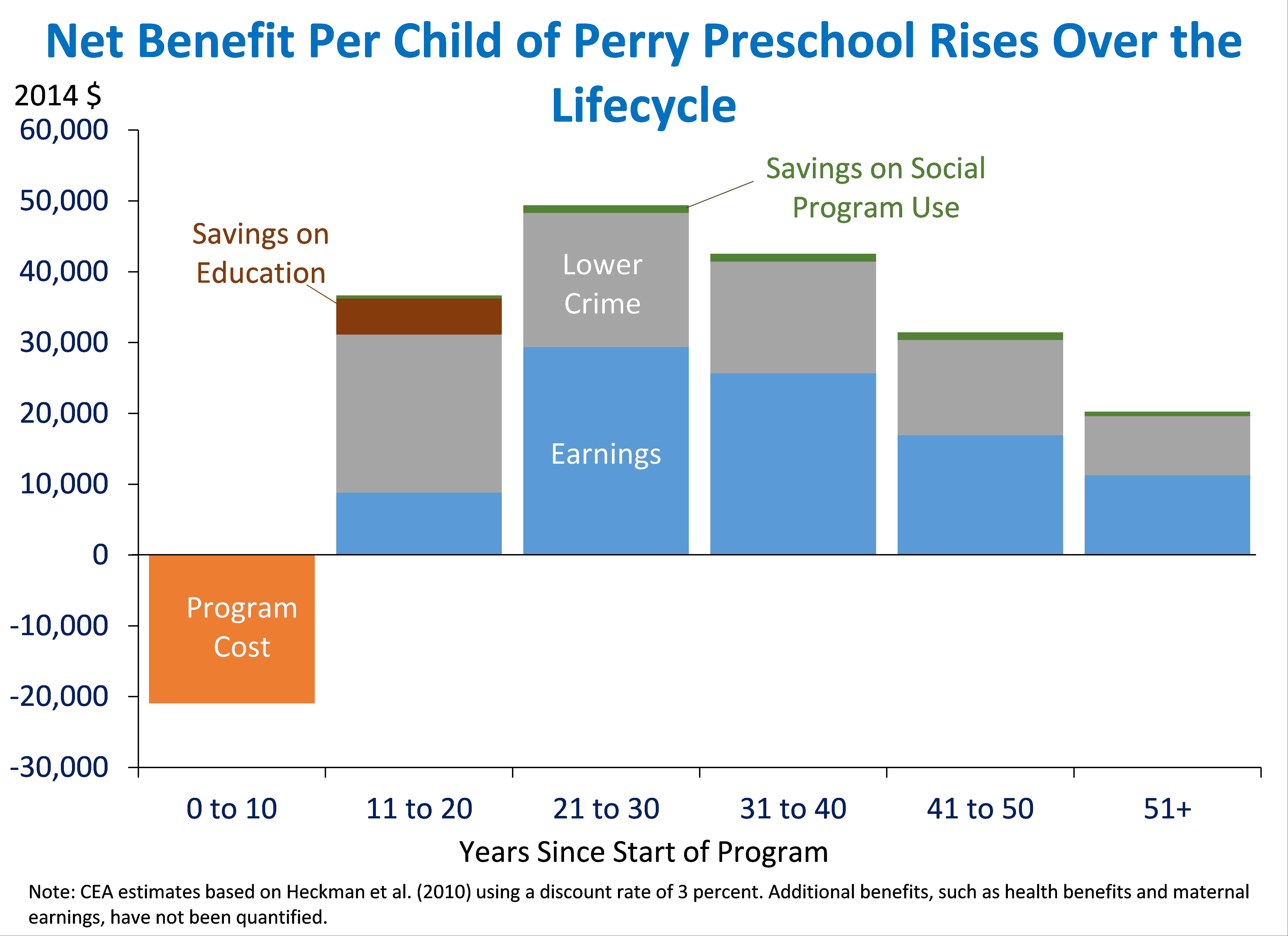

- Two famous randomized trials of relatively small, intensive early education programs targeted to disadvantaged young children were the Abecederian Project and the High/Scope Perry Preschool Study. Both of these programs conducted multiple follow-up surveys of these children through secondary school and into adulthood. A number of studies found that children from these programs saw higher high school graduation and college attendance rates and greater adult earnings, and Perry also showed lower involvement with the criminal justice system. CEA recently summarized this work and concluded early education programs yield positive net benefits of up to $8.60 for every dollar spent.

- Recent work finds that these positive outcomes aren’t limited to narrowly-targeted programs, but that modern programs like Head Start, also show promising results. The Head Start Impact Study (HSIS) is tracking nearly 5,000 children who participated in Head Start as 3- and 4-year olds in 2002-2003. So far, the study has examined children’s outcomes through 3rd grade. This work showed some positive initial findings, with greater language and literacy outcomes, but these results have become more attenuated over time, as measured by tests in elementary school.

- Even with negligible test score improvements in elementary and middle school, programs can still provide long-term benefits for children. For example, in order to account for differences in all family characteristics (unobserved and observed) David Deming compares differences between siblings in families where one sibling attended Head Start and another did not. Even though this work does show some fade-out, it also shows that in the longer-run, participating children are more likely to graduate high school and attend college.

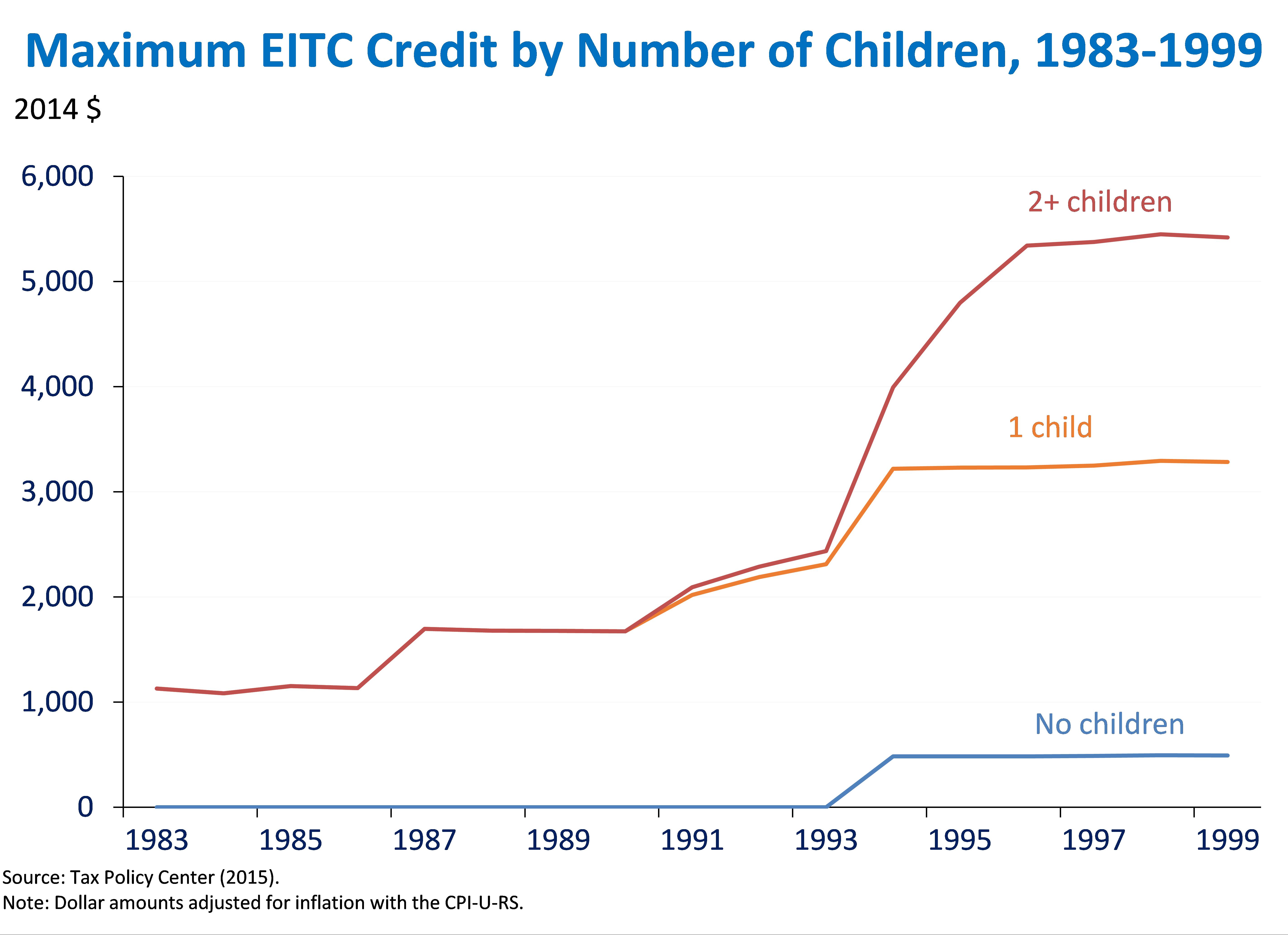

2. The Earned Income Tax Credit improves early health outcomes, and increases academic achievement and college attendance.

- The Earned Income Tax Credit (EITC) provides a refundable tax credit to lower-income working families. A family’s credit amount is based on the number of dependent children and its earnings. A long literature shows that the EITC increases labor force participation among single mothers. This work relies on quasi-experimental methods, often comparing families that became eligible for a (larger) credit with families with similar observable characteristics that were ineligible.

- The EITC has been expanded in every Administration since 1975. Examining the 1986, 1990, and 1993 reforms, which expanded the credit parameters, particularly for families with multiple children, Hilary Hoynes, Douglas Miller, and David Simon use Vital Statistics data covering all births from 1984 to 1998. These data provide information on birth weight and birth order, as well as some maternal demographic information. Since families with a first, second, or third and higher-order birth experience a different EITC schedule, the authors compare birth outcomes for single mothers across these groups and find an additional $1,000 in EITC receipt lowers the prevalence of low-birth weight by 2 to 3 percent. Using information from Vital Statistics on doctor visits during pregnancy and from birth certificate records on smoking and drinking during pregnancy, they speculate that one channel for health improvements is through better prenatal care and health.

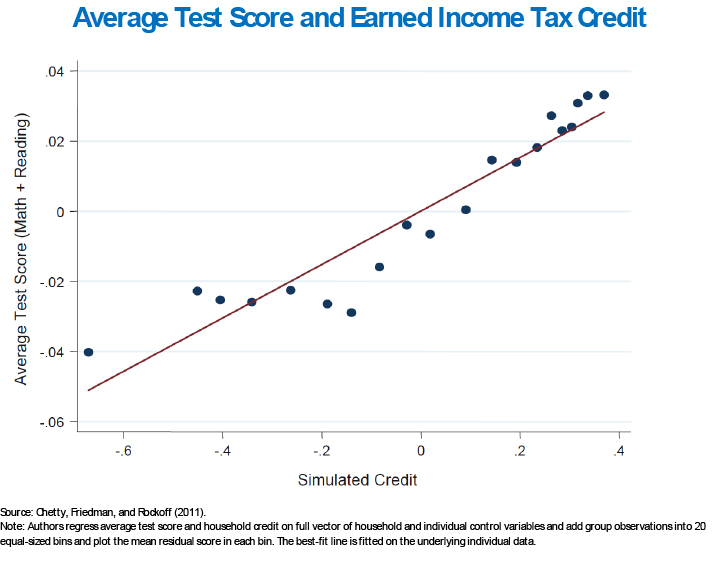

- The EITC for which a family is eligible increases at very low incomes, then remains flat for families with slightly higher incomes before phasing out. Work by Raj Chetty, John Friedman, and Jonah Rockoff uses these non-linearities in the tax schedule to identify the extent to which the credit improves academic performance. Linking data from a large school district on children’s test scores, teachers, and schools from grades 3 through 8 with administrative tax records on parental earnings, they find that a credit of $1,000 increases elementary and middle school test scores by 6 to 9 percent of a standard deviation. The authors’ related work suggests that the quality of a child’s teacher is correlated with improvements in test scores, but unrelated to other characteristics that might affect earnings (like family characteristics). Using teacher assignment to isolate the causal effect of test scores on future earnings, they estimate that these children’s future earnings gains will exceed the current EITC costs.

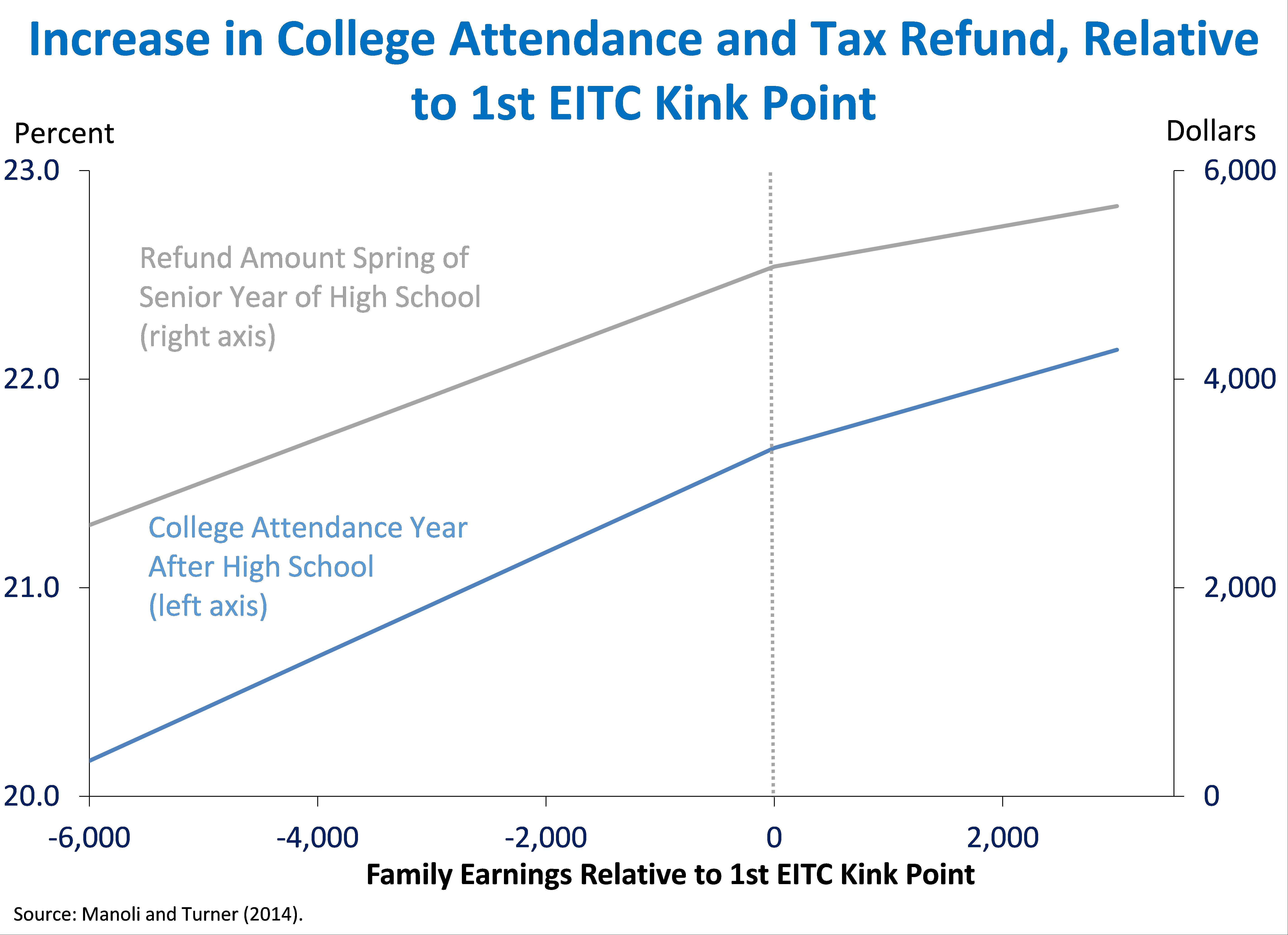

- Using a regression kink design to estimate changes near the EITC’s first kink point and a differences-in-differences estimation using expansions of the EITC’s plateau and phase-out region for married parents, Dayanand Manoli and Nicholas Turner find receiving an additional $1,000 EITC in a student’s senior year of high school increases college enrollment by 0.4 to 0.7 percentage points. While quasi-experimental methods, like regression kink and differences-in-differences strategies, have the potential to provide causal estimates, the validity of these designs often requires very large amounts of data. In this study, tax data provides information on family earnings and composition (from the 1040 form) and subsequent college enrollment (from the 1098-T form) on almost all high school seniors from 2001 to 2011, which enables them to examine how college-attendance behavior changes for children whose families are very close to, but on one side of, the policy change (a flat, rather than increasing, EITC or children of married parents versus single parents).

Even though we do not yet have a fully identified study of long-run earnings data for EITC recipients yet, by improving children’s performance in school, these results suggest the EITC could generate earnings gains in adulthood as well. For example, Chetty, Friedman, and Rockoff estimate that the test score gains will translate into earnings gains of 9 percent.

3. Nutrition assistance programs improve health outcomes and economic self-sufficiency.

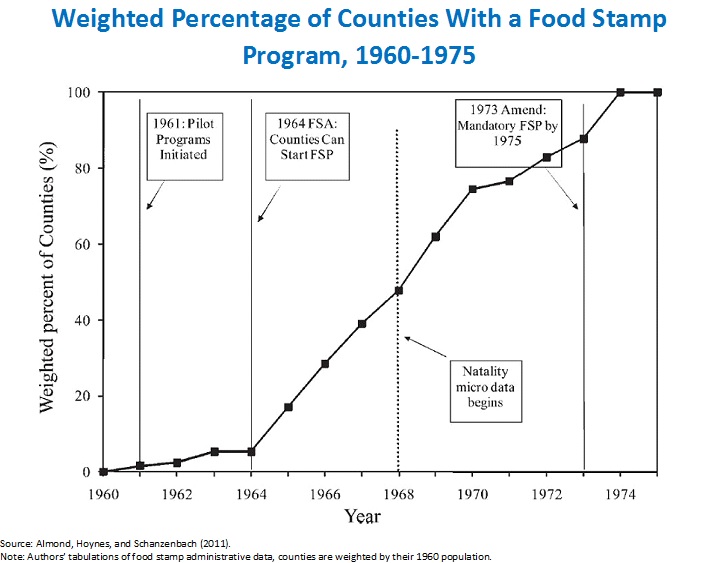

- The Food Stamp Program (now SNAP) was rolled out across counties between 1961 and 1975, and the time at which a county implemented the program is largely unassociated with observable county characteristics. Douglas Almond, Hilary Hoynes, and Diane Whitmore Schanzenbach use this phased implementation to compare children from disadvantaged families who were born at similar times, but in different counties, and therefore had differential access to the Food Stamp program. Vital Statistics Natality administrative data that provides information on birth weight and parity and maternal characteristics shows that access to Food Stamps during pregnancy reduces low-birth weight births, with the greatest gains at the lower-end of the birth weight distribution. Related work using similar cross-state variation and linking longitudinal data that follows children throughout adolescence and into adulthood shows that access to Food Stamps before birth and at young ages reduces metabolic syndrome and increases economic self-sufficiency for women.

- Like the Food Stamp program, the Supplemental Nutrition Program for Women, Infants, and Children (WIC) was rolled out in stages between 1972 and 1979. Work by Hilary Hoynes, Marianne Page, and Ann Huff Stevens uses this county variation to compare birth information from the Vital Statistics Natality Data among children who were born at similar times, but in different counties (with different in uetro exposure to WIC). These results suggest that WIC increased birthweights among children born to mothers who participated in WIC from the third trimester between 18 to 29 grams, and effects were largest among mothers with low levels of education.

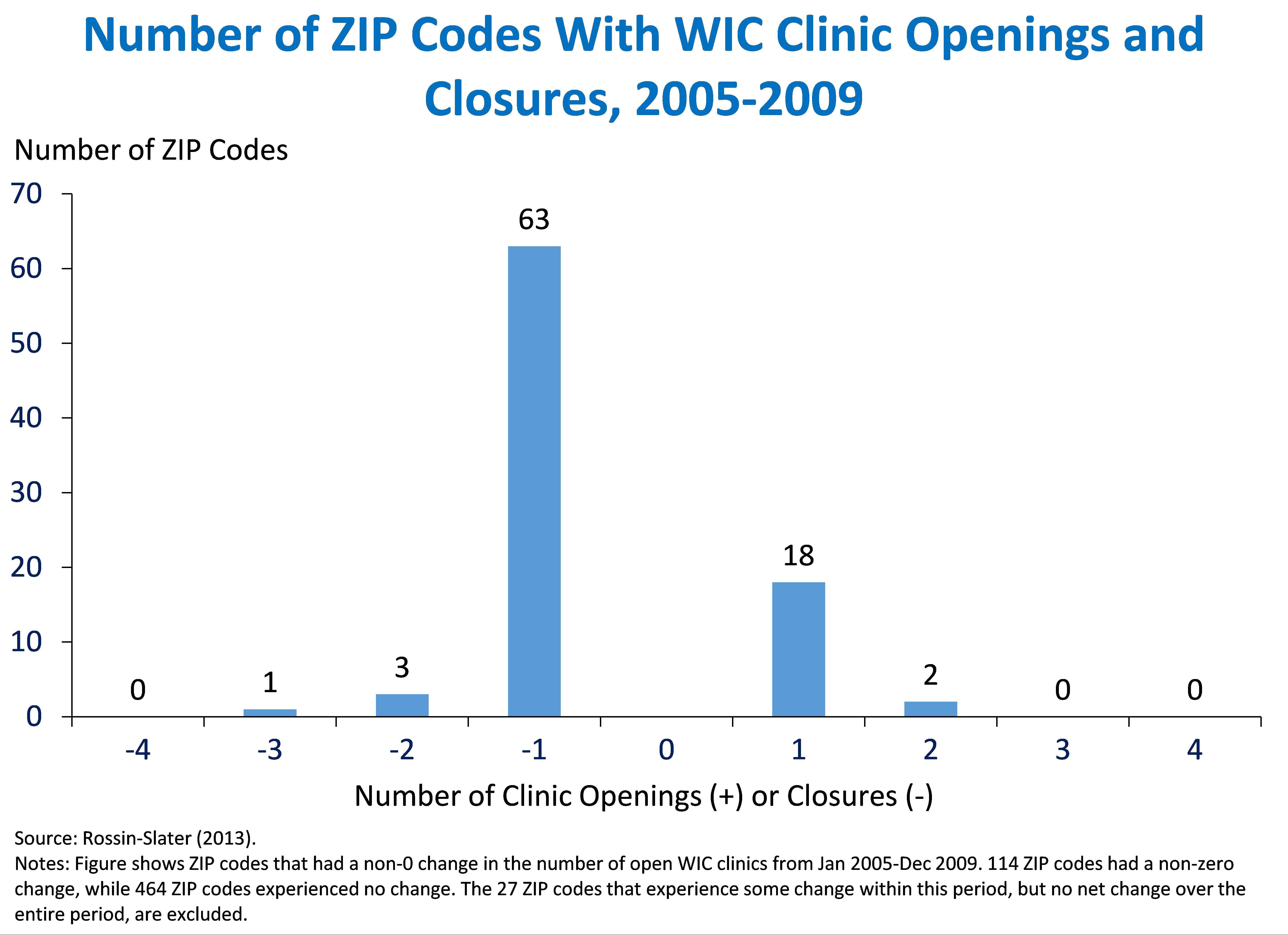

- Other work uses more recent data on access to WIC at finer geographies. In some states, like Texas, clients must apply for WIC in person, and distance to a clinic can present a barrier to access. Maya Rossin-Slater examines data from the Texas Department of State Health Services on WIC clinic openings, which includes operating dates and ZIP codes for all clinics in the state, and birth record data which includes information on birth outcomes and maternal characteristics. In order to isolate the causal effect of WIC access, she compares birth outcomes between siblings, where one sibling was born when a clinic was open nearby but another was born without access to a nearby clinic. This work shows that WIC access increased maternal weight gain during pregnancy, children’s birth weights, and the likelihood of initiating breastfeeding upon discharge from the hospital following birth.

4. Housing assistance that enables families to move to areas with high levels of upward mobility improves college enrollment, adult earnings, and marriage rates.

- From 1994 to 1998, the Moving to Opportunity demonstration project (MTO) randomly selected low-income families living in public housing in areas of concentrated poverty to receive housing vouchers. The experimental voucher group was required to move to neighborhoods with poverty rates below 10 percent, but Section 8 voucher recipients faced no location restrictions. Randomized control trials, such as MTO, are considered the “gold-standard” in economic research since treatment status is, by definition, random, and not correlated with characteristics that might influence future outcomes. As such, randomized experiments can credibly isolate the causal effect of a program. Interim results from the experiment found some benefits to moving to low-poverty neighborhoods, like improvements in mental and physical health among adults and teenage girls, but the fact that it did not lead to earnings increases for adults or test score improvements for children was disappointing.

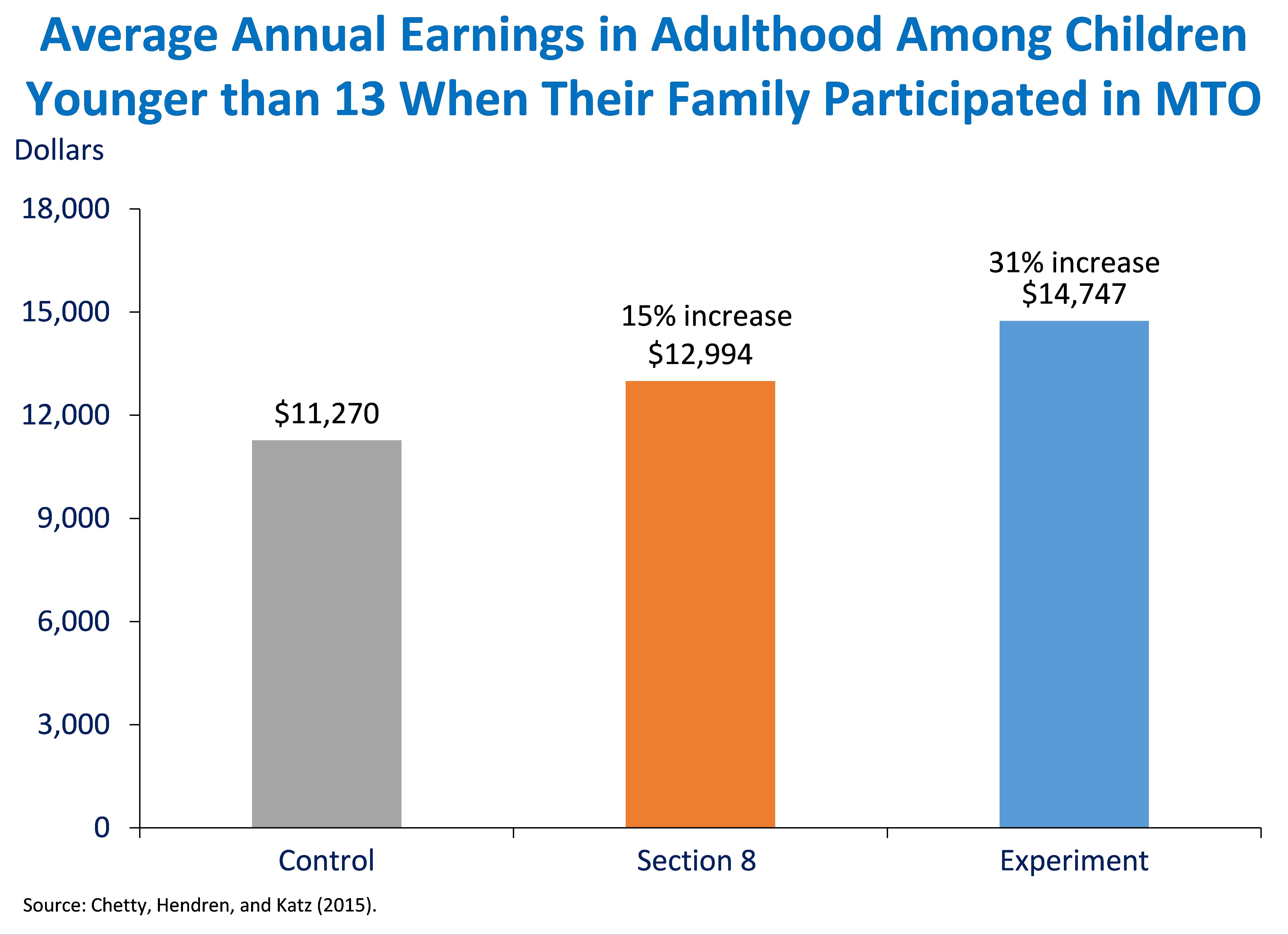

- In contrast to the earlier literature, work released last week by Raj Chetty, Nathaniel Hendren, and Lawrence Katz links the MTO data with administrative earnings data for participating children. Previous work had relied on test score results to infer that the program would have little effect on achievement-related outcomes, or relied on earnings records from the oldest participants, but actual earnings records from a greater share of participants show substantial earnings gains. Among children who were younger than 13 when their families moved, Section 8 vouchers increased earnings by 15 percent and experimental vouchers increased earnings by 31 percent. In addition, MTO increased college attendance by 32 percent and, among children who attended college, children whose families received vouchers went to higher-quality schools. While the program did not affect significantly either overall birth rates or teen birth rates, experimental vouchers did increase the fraction of births where a father was present, and both Section 8 and experiment vouchers increased female marriage rates between ages 24 and 30. In contrast to the results for younger children, older children did not see these positive outcomes, suggesting that the amount of time a child spends in a neighborhood matters for adult outcomes, and providing a reconciliation with the earlier literature.

5. Medicaid/CHIP receipt in childhood improves adult economic and health outcomes.

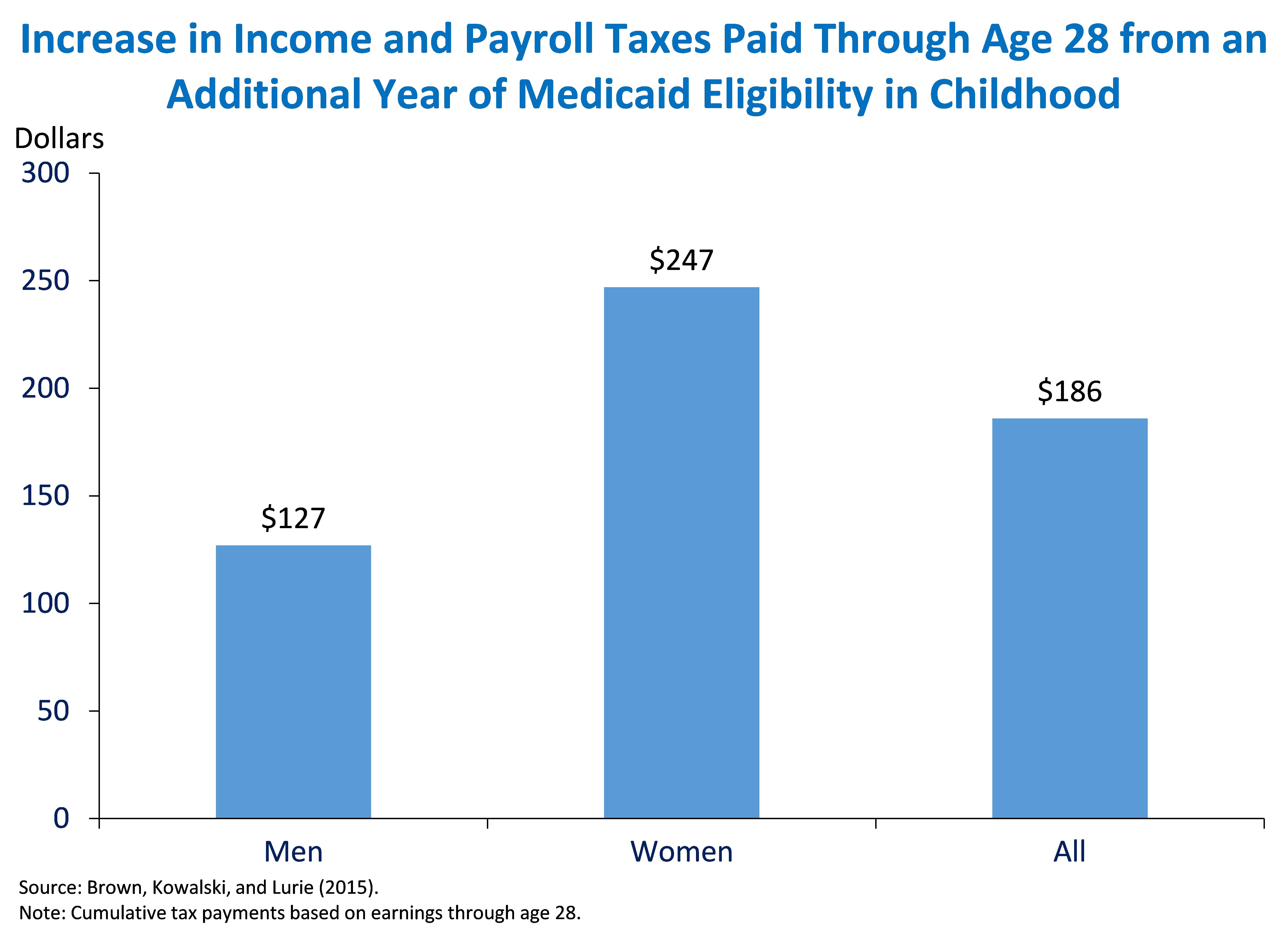

- States expanded access to health insurance for children through Medicaid and the Children’s Health Insurance Program (CHIP) at different times and to different extents since the 1980s. Using this variation and administrative data that connect individuals’ adult earnings and tax information to their residence and family income in childhood, David Brown, Amanda Kowalski, and Ithai Lurie estimate that a single additional year of Medicaid/CHIP eligibility in childhood increased cumulative tax payments through just age 28 by $186, a substantial fraction of the cost of that coverage; increasing Medicaid/CHIP eligibility also increased female earnings through age 28.

- Related work by Sarah Cohodes, Daniel Grossman, Samuel Kleiner, and Michael Lovenheim uses similar variation across States and time in Medicaid/CHIP eligibility rules. They find that individuals who were eligible for Medicaid/CHIP in childhood were more likely to complete high school and graduate from college.

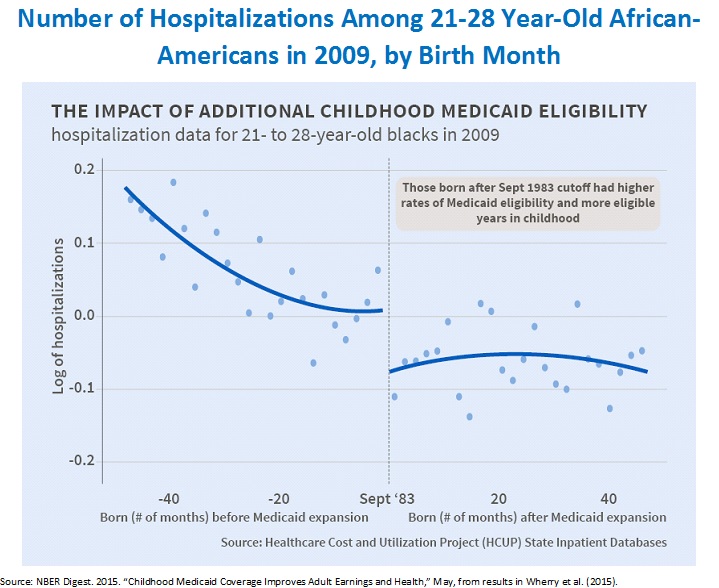

- One possible explanation for the improvements in economic outcomes due to Medicaid receipt in childhood is that Medicaid generates long-lasting improvements in health status. Two studies by Bruce Meyer, Laura Wherry, and co-authors examine changes in Federal Medicaid eligibility rules caused children born in October 1983 or later to be more likely to qualify for Medicaid coverage between ages 8 and 14 than children born before October 1983. These studies find that, in the groups most affected by the discontinuity in coverage eligibility, children born during or after October 1983 experience lower mortality in their late teen years and are substantially less likely to be hospitalized as adults.

6. Cash assistance programs that help low-income families make ends meet increase earnings, educational attainment, and longevity.

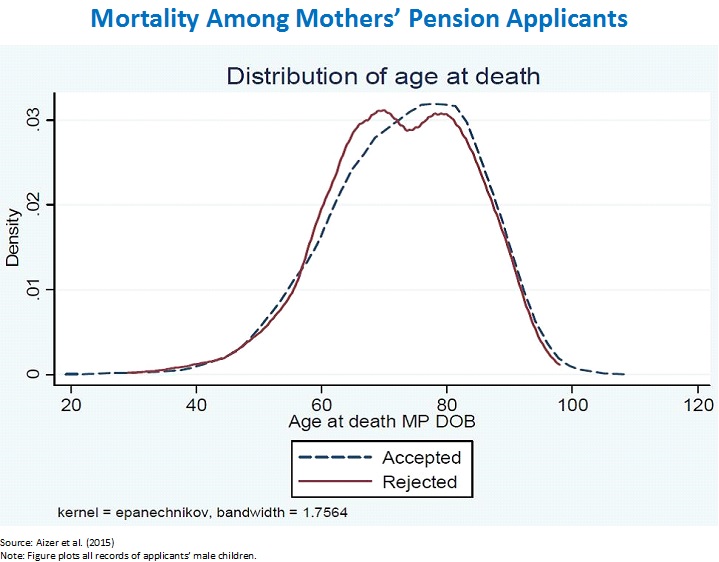

- Anna Aizer, Shari Eli, Joseph Ferrie, and Adriana Lleras-Muney examined the Mothers’ Pension, a cash assistance program in effect from 1911 to 1935, and a precursor to Temporary Assistance to Needy Families. The authors use data from World War II enlistment records, the Social Security Death Master File through 2012, and 1940 Census records on 16,000 men to compare mortality of children who benefited from the program to similar children of the same age living in the same county whose mothers applied, but were denied benefits. They find that the program reduced mortality through age 87 among recipient children, and that the lowest-income children experienced the largest benefits. Census and enlistment records suggest that these improvements may be at least partly due to the improvements in nutritional status (measured by underweight status in adulthood), educational attainment, and income in early-to-mid adulthood. Documenting that the most common reason for rejection was “insufficient need,” the authors argue their results provide a lower-bound estimate of the program’s effects.

These six examples show that programs can have large and real long-term benefits, even if in some cases interim results based on indirect measures like test scores suggest little effect. They also show how credible research designs and greater access to data can overcome some of the limitations of previous work. Finally, these results suggest that, in some circumstances, greater equity does not necessarily come at the cost of lower economic efficiency. In fact, in instances where cost-benefit analyses are available, the additional tax revenue from the higher long-run earnings stemming from these programs is sufficient to cover most or all of the initial cost. This work shows that many investments proposed in the President’s Budget would help both participants and the overall economy.

Jason Furman is the Chairman of the Council of Economic Advisers. Krista Ruffini is a Research Economist for the Council of Economic Advisers.