Today, at 7:00 pm EST, Chairman of the Council of Economic Advisers Alan Krueger will deliver remarks on income inequality and rebuilding the middle class at the Rock and Roll Hall of Fame.

As he'll discuss this evening, using rock and roll industry as a example is one of the best ways to explain economics -- many of the forces that are buffeting the U.S. economy can be understood in the context of the music industry.

- Download Chairman Krueger’s remarks and charts as a PDF

- See the full remarks and charts on WhiteHouse.gov

Read the remarks as prepared for delivery below.

Land of Hope and Dreams: Rock and Roll, Economics, and Rebuilding the Middle Class

Alan B. Krueger, Chairman, Council of Economic Advisers

Cleveland, OH

Remarks as prepared for delivery

Thank you very much for your kind introduction. I have always felt that this is a magnificent museum, one of the few in the world that brings people of all backgrounds together, young and old, rich and poor – there is something here for everyone to marvel at. Particularly at a time when economic forces have been chipping away at the middle class for decades, I think it is essential to have institutions like the Rock and Roll Hall of Fame that can bring people together, and remind us that we are one nation, united by our hopes and dreams.

I gave this talk the title, “Land of Hope and Dreams: Rock and Roll, Economics and Rebuilding the Middle Class” because many of the forces that are buffeting the U.S. economy can be understood in the context of the music industry. I have also learned from 25 years of teaching that the best way to explain economics is through the example of the rock ‘n roll industry.

The music industry is a microcosm of what is happening in the U.S. economy at large. We are increasingly becoming a “winner-take-all economy,” a phenomenon that the music industry has long experienced. Over recent decades, technological change, globalization and an erosion of the institutions and practices that support shared prosperity in the U.S. have put the middle class under increasing stress. The lucky and the talented – and it is often hard to tell the difference – have been doing better and better, while the vast majority has struggled to keep up.

These same forces are affecting the music industry. Indeed, the music industry is an extreme example of a “super star economy,” in which a small number of artists take home the lion’s share of income.

The music industry has undergone a profound shift over the last 30 years. The price of the average concert ticket increased by nearly 400% from 1981 to 2012, much faster than the 150% rise in overall consumer price inflation.

And prices for the best seats for the best performers have increased even faster.

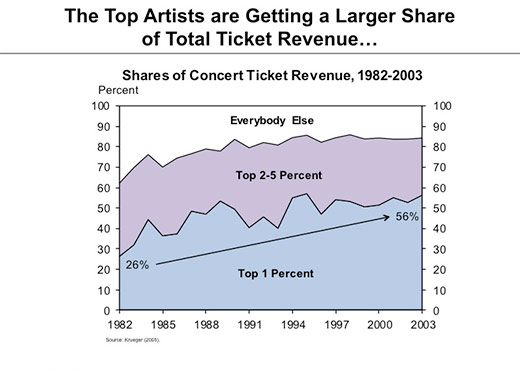

At the same time, the share of concert revenue taken home by the top 1% of performers has more than doubled, rising from 26 percent in 1982 to 56 percent in 2003.

The top 5 percent take home almost 90 percent of all concert revenues.

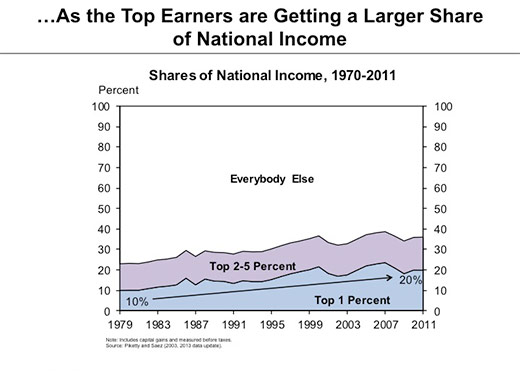

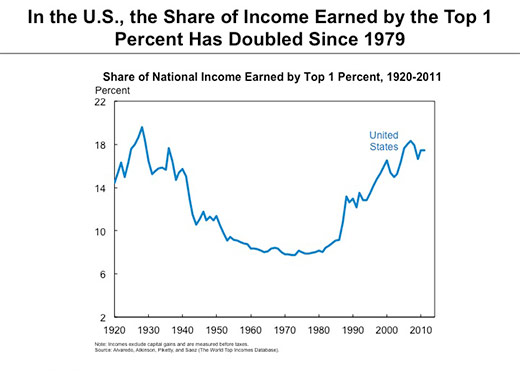

This is an extreme version of what has happened to the U.S. income distribution as a whole. The top 1% of families doubled their share of income from 1979 to 2011.

In 1979, the top 1% took home 10 percent of national income, and in 2011 they took home 20%. By this measure, incomes in the entire U.S. economy today are almost as skewed as they were in the rock ‘n roll industry when Bruce Springsteen cut “Born in the U.S.A.”

In my talk, I will focus on why these dramatic changes are taking place and explore their consequences. I will also describe President Obama’s vision for providing more opportunities for middle class families and those struggling to get into the middle class.

I should be clear about my overall theme: while the U.S. economy is recovering from the worst financial and economic crisis since the Great Depression, we must also take steps to strengthen the middle class and provide more opportunities for those born to less fortunate circumstances. If we don’t, we will fail to live up to our promise as a Nation and be susceptible to the kinds of forces that created economic instability in the past. To rebuild the economy from the middle out, the private sector will have to step up and reinvigorate the norms and institutions that have supported inclusive growth in the past. The government has an important role to play as well, but with severe budget constraints and limited political will, the government can only set the conditions for the private sector to grow, and provide more jobs and opportunities for middle class families. It is, to a considerable extent, up to private sector businesses, organizations and communities to ensure that economic growth leads to widely shared prosperity and a decent living for the vast majority of our people.

Let me start with the economics of the music industry, and then turn to the economy at large.

Rockonomics

I want to highlight four factors that are important in generating a superstar economy. These are technology, scale, luck and an erosion of social norms that compress prices and incomes. All of these factors are affecting the music industry.

The idea of a “super star economy” is very old. It goes back to Alfred Marshall, the father of modern microeconomics. In the late 1800s, Marshall was trying to explain why some exceptional businessmen amassed great fortunes while the incomes of ordinary artisans and others fell. He concluded that changes in communications technology allowed “a man exceptionally favored by genius and good luck” to command “undertakings vaster, and extending over a wider area, than ever before.”

Ironically, his example of a profession where the best performers were unable to achieve such super star status was music. Marshall wrote, “so long as the number of persons who can be reached by a human voice is strictly limited, it is not very likely that any singer will make an advance on the £10,000 said to have been earned in a season by Mrs. Billington at the beginning of the last century, nearly as great [an increase] as that which the business leaders of the present generation have made on those of the last.”

Elizabeth Billington reputedly was a great soprano with a strong voice, but she did not have access to a microphone or amplifier in 1798, let alone to MTV, CDs, iTunes, and Pandora. She could only reach a small audience. This limited her ability to dominate the market.

Modern economists have elaborated on Alfred Marshall’s insights. The economist Sherwin Rosen developed a theoretical model in which super star effects are driven by “imperfect substitution” and “scale” in production. Simply put, imperfect substitution means that you would rather listen to one song by your favorite singer than a song and a half by someone else. Or, in another context, it means that if you need to have heart surgery, you would rather have the best surgeon in Cleveland perform it rather than the second and third best together.

Scale means that one performer can reach a large audience.

Technological changes through the centuries have long made the music industry a super star industry. Advances over time including amplification, radio, records, 8-tracks, music videos, CDs, iPods, etc., have made it possible for the best performers to reach an ever wider audiencewith high fidelity.

And the increasing globalization of the world economy has vastly increased the reach and notoriety of the most popular performers. They literally can be heard on a worldwide stage.

But advances in technology have also had an unexpected effect. Recorded music has become cheap to replicate and distribute, and it is difficult to police unauthorized reproductions. This has cut into the revenue stream of the best performers, and caused them to raise their prices for live performances.

My research suggests that this is the primary reason why concert prices have risen so much since the late 1990s. In this spirit, David Bowie once predicted that “music itself is going to become like running water or electricity,” and, that as a result, artists should “be prepared for doing a lot of touring because that’s really the only unique situation that’s going to be left.” While concerts used to be a loss leader to sell albums, today concerts are a profit center.

But there are limits to how much artists can charge their fans for concert tickets because of social pressures. Most people do not want to think of their favorite singer as greedy. There are a lot of great singers to choose from. Would you rather listen to a singer who is committed to social causes you identify with, or one who is only in it for the money? Part of what you are buying when you buy a recording or concert ticket is the image of the performers. The image and the music are intrinsically linked.

Some of our greatest artists have also been great champions of important social and economic causes, including George Harrison, Joan Baez and Bono.

If artists charge too much for their tickets, they risk losing their appeal. In this sense, the market for rock ‘n roll music is different from the market for commodities, or stocks and bonds. Considerations of fair treatment exert pressure on how much musicians can charge, even superstars.

Along these lines, one of my favorite performers, Tom Petty, once said, “I don’t see how carving out the best seats and charging a lot more for them has anything to do with rock & roll.”

And artists like Garth Brooks and, more recently, Kid Rock have made a point of charging a low price for all of the seats in the house when they perform.

In fact, the best seats for the hottest concerts have historically been underpriced. This is a major reason why there is a market for scalped tickets.

But many artists have been reluctant to raise prices to what the market will bear for fear of garnering a reputation of gouging their fans.

They also protest when tickets sell for a higher price on the secondary market, and often try to prevent the secondary market entirely. And it is considered scandalous when performers sell tickets on the secondary market themselves.

This behavior can only be explained in light of fairness considerations. Singers want to be viewed as treating their fans fairly, rather than charging them what supply and demand dictate. Indeed, you can think of market demand as depending on the perception of fairness.

In many respects, concerts could be thought of as a giant block party instead of a traditional market. While it is socially appropriate to charge neighbors some fee for coming to a block party to pay for the provisions, it is inappropriate to charge them enough to make a hefty profit. There is a compact that fans come and bring their enthusiasm and support for the band, and the band charges a reasonable price and puts on a good show.

Now, as inequality has increased in society in general, norms of fairness have been under pressure and have evolved.

Prices have risen for the best seats at the hottest shows – and made it possible for the best artists to make over $100 million for one tour – but this has come with a backlash from many fans who feel that rock ‘n roll is straying from its roots. And this is a risk to the entire industry.

Let me next turn to the role of luck. I said “best artists,” but I also could have added luckiest artists. Luck plays a major role in the rock ‘n roll industry. Success is hard to judge ahead of time, and definitely not guaranteed, even for the best performers. Tastes are fickle, and herd behavior often takes over.

Even the experts, with much at stake, have difficulty picking winners. Columbia Records turned down Elvis Presley in 1955 and the Beatles in 1963. They turned down Bob Dylan in 1963, and almost rejected “Like a Rolling Stone” in 1965, which was later named the greatest rock ‘n roll song ever by Rolling Stone magazine.

Or consider Sixto Rodriguez, the subject of the documentary movie Searching for Sugar Man. Rodriguez recorded two-and-a-half albums from 1970 to 1975, which were commercial flops. But he was a huge success in South Africa, and his music became the battle hymn of the anti-Apartheid movement. And – amazingly – he was unaware of his fame and influence.

Both good and bad luck play a huge role in the rock ‘n roll industry. And the impact of luck is amplified in a superstar economy.

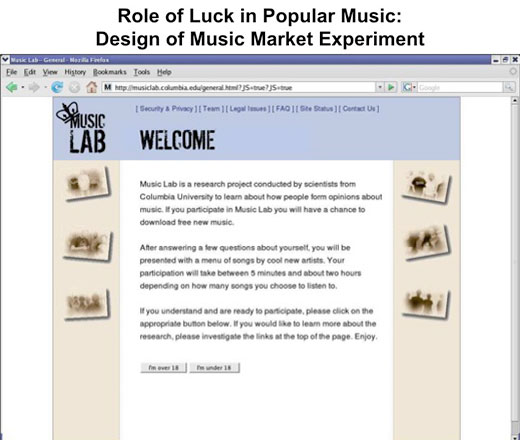

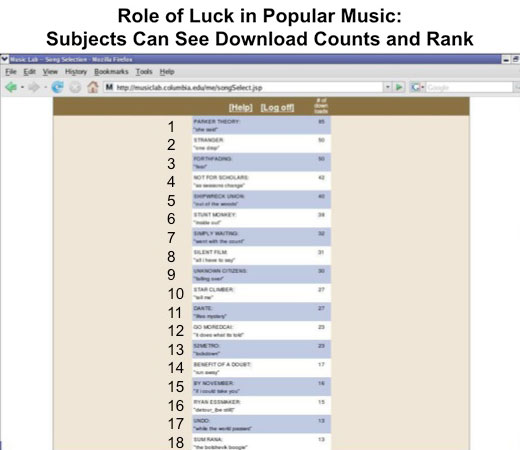

This was clearly demonstrated in a fascinating experiment conducted by the sociologists Matt Salganik and Duncan Watts. With the musicians’ permission, the researchers posted 48 songs in an online music library. Subjects were invited to log on to the library and sample the songs, with the opportunity to download the songs for free.

Participants could see the list of songs, ranked by the number of times each one had been downloaded up to that point. They could also see the exact download counts, so they were aware of the popularity of each song based on the collective opinions of other participants.

From there, the subjects could click on a song to play it, and then were given the option to download the song for free.

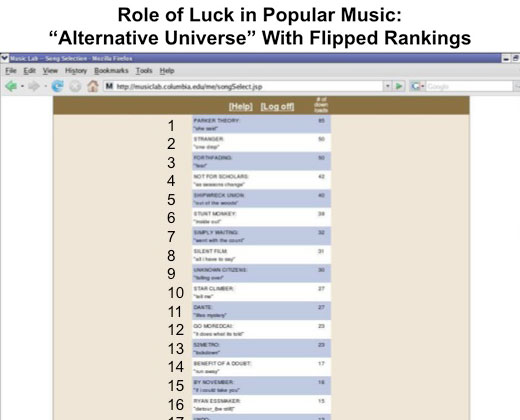

For the first 750 participants, the researchers faithfully tallied and displayed the number of downloads. However, the subsequent 6,000 participants were randomly – and unknowingly – assigned to one of two alternative universes. In one universe, they continued to see the true download counts.

For the other participants, the researchers deviously created an alternative universe where the download counts had been flipped, so that the 48th song was listed as the most popular song, the 47th song was listed as the number two song, and so on. After this one-time inversion in the ranking, the researchers let the download tallies grow on their own. They wanted to see if the cream would rise to the top, or if the boost in ranking that the worst song received would lead it to become popular.

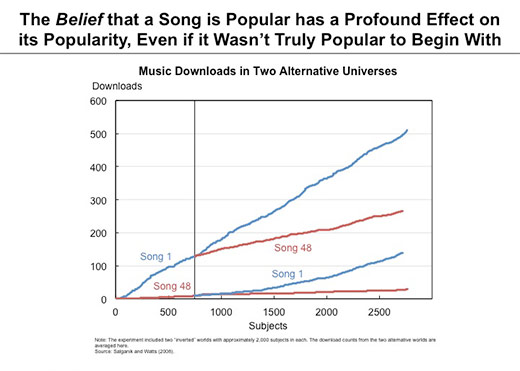

Here’s what happened in the world where the download counts were presented accurately.

By the end of the experiment, the top song (“She Said” by Parker Theory) had been downloaded over 500 times, while the least popular song (“Florence” by Post Break Tragedy) had been downloaded just 29 times – so the natural outcome of the experiment was that the most popular song was nearly 20 times more popular than the least popular song.

Now let’s see what happened when the download counts were flipped, so that the new participants thought the least popular song was actually the most popular. As you can see, the download count for the least popular song grew much more quickly when it was artificially placed at the top of the list. And the download count for the most popular song grew much more slowly when it was artificially placed at the bottom of the list.

In the alternative world that began with the true rankings reversed, the least popular song did surprisingly well, and, in fact, held onto its artificially bestowed top ranking. The most popular song rose in the rankings, so fundamental quality did have some effect. But, overall – across all 48 songs – the final ranking from the experiment that began with the reversed popularity ordering bore absolutely no relationship to the final ranking from the experiment that began with the true ordering. This demonstrates that the belief that a song is popular has a profound effect on its popularity, even if it wasn’t truly popular to start with.

A more general lesson is that, in addition to talent, arbitrary factors can lead to success or failure, like whether another band happens to release a more popular song than your band at the same time. The difference between a Sugar Man, a Dylan and a Post Break Tragedy depends a lot more on luck than is commonly acknowledged.

Decent Wages

Let me next turn to the economy more generally. The same forces of technology, scale, luck and the erosion of social pressures for fairness that are making rock ‘n roll more of a superstar industry also are causing the U.S. economy to become more of a winner-take-all affair.

The effects of technological change and globalization on inequality have been well documented in the past.

It is abundantly clear that computer and information technology has revolutionized the way work is done in the U.S. In 1984, less than a quarter of workers directly used a computer on their job. Today, nearly two thirds of workers directly touch a keyboard at work, and millions of others have had their jobs altered by embedded computers and information technology. Computer and information technology has reduced the demand for jobs that can be routinized, and increased the demand for highly educated workers who can use the technology to increase their productivity

The U.S. economy has also become much more integrated with the world economy in recent decades. While exports and imports made up only 11 percent of GDP in 1970, they made up 31 percent last year. You see signs of globalization everywhere: for example, American bands tour much more internationally today than they used to. A more globally connected economy increases the reach of successful entrepreneurs and artists, but also brings many more low-wage workers into competition with our workforce.

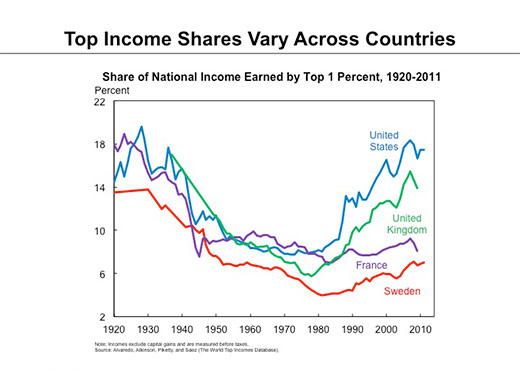

These developments have contributed to some of the momentous changes we have seen in the U.S. economy. This chart shows the share of total income going to the top 1% of families starting in 1920.

During the Roaring ‘20s inequality was very high, with the top 1% taking in nearly 20% of total income. This remained the case until World War II. Price and wage controls and the patriotic spirit that “we’re all in it together” during World War II caused inequality to fall. Interestingly, the compression in income gaps brought about by World War II persisted through the 1950s, 1960s and 1970s. Beginning in the 1980s, however, inequality rose significantly in the U.S., with the share of income accruing to the top 1% rising to heights last seen in the Roaring ‘20s.

After World War II, a social compact ensured that workers received a fair share of the gains of economic growth. This was enforced by labor unions, progressive taxation, a minimum wage that increased in value, anti-discrimination legislation and expanding educational opportunities.

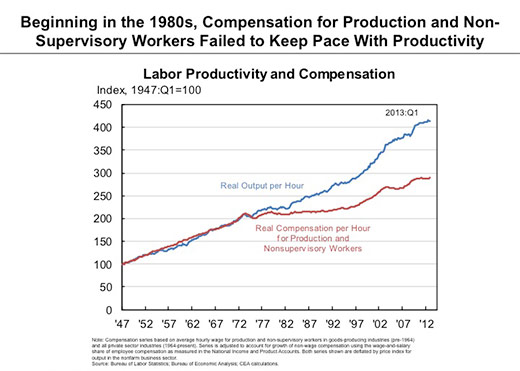

This social compact was good for business and good for the economy. But the social compact began to fray in the 1980s. You can see from the following chart that wages of production and nonsupervisory workers moved pretty much in lockstep with productivity until the late 1970s.

Since the 1980s, however, labor compensation has failed to keep pace with productivity growth, and this has put stress on middle class workers.

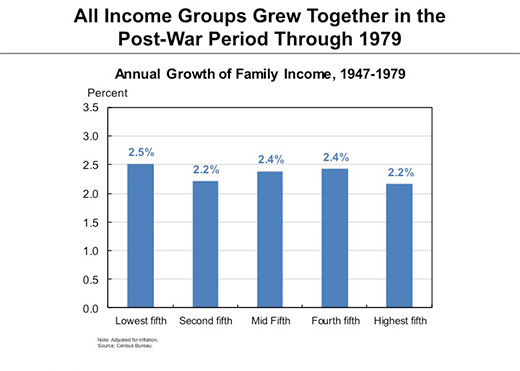

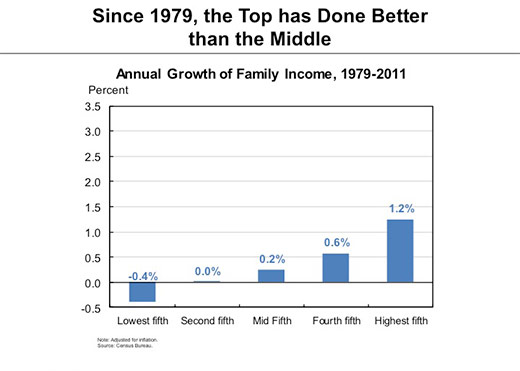

The next two charts show what has happened to income growth in other parts of the distribution.The charts show average annual income growth for families broken down to whether they are in the poorest fifth, second poorest fifth, and so on.

First look at the post-war period through 1979.

All segments grew together. But since 1979, the top has done better than the middle – which has barely grown over three decades – and those in the bottom have done even worse, with real income declining.

An astonishing 84 percent of total income growth from 1979 to 2011 went to the top 1 percent of families, and more than 100 percent of it from 2000 to 2007 went to the top 1 percent.

These trends are driven by a pulling apart of wages, with much faster wage growth for the highest income earners over the last three decades, and wages barely keeping pace with inflation or falling behind for everyone else.

Now the forces that brought about these changes were not unique to the U.S., but they have had a more dramatic effect in the U.S. Consider the following chart again with other countries added.

Inequality has followed a broadly similar trend in the U.K., France and Sweden, for example. But notice that the level of inequality varies considerably across these countries, and the rise in the share going to the top 1% varies considerably as well. In Sweden, for example, the share of income brought home by the top 1% rose just 3 percentage points, from 4% in 1980 to 7% in 2011, while in the U.S. it doubled from 10% to 20%.

The widely differing responses to globalization and technological change suggest that other factors mediate these forces.

This brings me to discuss the role of luck, education and institutions that ensure that prosperity is broadly shared.

Globalization and technological change have increased the payoff to completing more education. Countries that have expanded access to education have weathered the polarizing effects of technological change and globalization to a better extent.

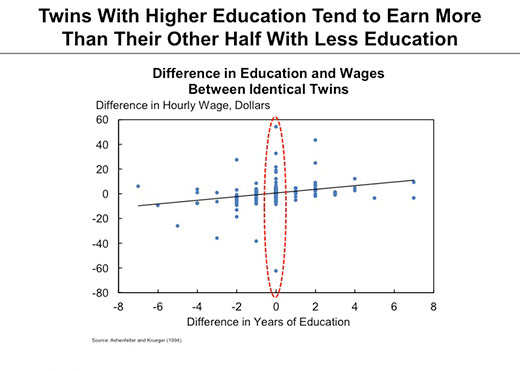

To demonstrate the economic benefit of education, I’ll describe a study that a colleague and I conducted not very far from here, in Twinsburg, OH. For four summers in a row in the 1990s, we went to the Twins Days Festival in Twinsburg. We interviewed identical twins about their education and their incomes. We were particularly interested in knowing whether a twin who had more education than his sibling also had higher income.

The following graph shows the difference in wage rates and years of education between pairs of twins. You can see that, on average, twins with higher education tend to earn more than their other half with less education.

On average, we find that completing four more years of education is associated with 60 percent higher wages. This and other studies demonstrate that education has a high payoff, on average.

But, as we saw in the rock ‘n roll industry, luck also matters. Consider identical twins with the same level of education. They were raised by the same family, under the same roof, and typically were dressed alike and went to the same school. They are as alike as two peas in a pod.

Yet in most cases they have very different economic outcomes as adults. Earnings differed by 25% or more for pairs of identical twins in half of our sample. And earnings differed by more than 50% in a quarter of identical twins with identical school levels.

These discrepancies for such similar workers suggest that luck is an important factor in the labor market, as well as in the music industry.

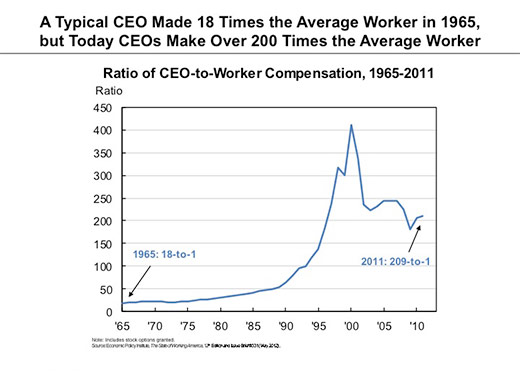

As in the music industry, the effect of luck is amplified in a winner-take-all economy. Consider the pay of CEO’s.

The pay of top executives relative to their workers has soared since the 1980s. In 1965 the average CEO earned about 18 times as much as the average worker; now the average CEO earns over 200 times as much.

As in Alfred Marshall’s time, successful executives can now command undertakings on a much vaster scale. This undoubtedly has played a role.

But luck and an erosion of norms of fairness have also boosted CEO pay in many cases. For example, Marianne Bertrand and Sendhil Mullainathan show that the compensation paid to CEO’s of oil companies jumps when the price of oil rises. Since the price of oil is set on a world market, with gyrations caused by geopolitical forces well beyond the control of CEO’s, movements in the price of oil have nothing to do with their job performance. Yet they benefit when the price of oil rises.

Next, let me consider the role that fairness plays in the economy. We already saw that social pressures for fairness affect the concert industry.

Workers, like music fans, expect to be treated fairly, and if they perceive they are paid unfairly their morale and productivity suffer.

To examine the role of fairness at the workplace, in a recent experiment Ernst Fehr and coauthors randomly varied the pay of members of pairs of workers who were hired to sell membership cards to discotheques in Germany. Obviously, it is not fair if, by luck of the draw, your pay is lower than that of your co-worker who was hired to do the exact same job. They found that increasing the disparity in pay between pairs of workers decreased the productivity of the two workers combined. Their findings suggest that a more equal distribution of wages would be good for business because it would raise morale and productivity.

This conclusion is reinforced by fascinating new research by Alex Edmans of Wharton. Edmans finds that when a company makes the list of the “100 Best Companies to Work for in America” its stock market value subsequently rises by 2 to 4 percent per year. Because employee morale suggests that treating workers fairly is in shareholders’ interests. Unfortunately, too many executives have strayed from this ethic, to the detriment of their shareholders and the economy.

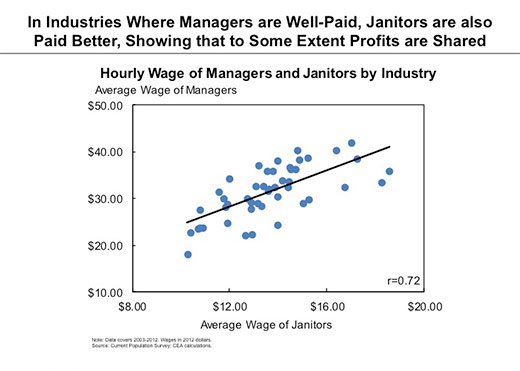

The notion that profitable companies should share some of their success with their workforce used to be ingrained in U.S. companies. Earlier studies have found that companies and industries that are profitable tend to pay all of their workers relatively well, the managers as well as the janitors. In economics we call this “rent sharing”. While this is still the case, the practice has been eroded. The following chart shows the relationship between the average pay of managers and janitors across industries in the 2000s.

The correlation is 0.7, indicating that pay is higher for janitors in industries where managers are relatively well paid. If the same analysis is done using data for 1980s, however, the correlation is higher (0.8), indicating that there used to be a stronger tendency for janitors’ pay to move together with that of managers in their industry. This suggests that companies are less likely to share their profits with all workers.

It is not hard to find reasons why the institutions and practices that long enforced norms of fairness in the labor market have been eroded. At a time when market forces were pushing an increasing share of before-tax income toward the wealthiest Americans, the previous administration cut taxes disproportionately for the well off.

Even earlier, in the 1980s when inequality was starting to take off, the nominal value of the minimum wage was left unchanged from 1981 to 1989, causing it to decline in the value by 27 percent after accounting for inflation. The minimum wage serves as an important anchor for other wages, and the whole wage scale was brought down by the decline in the minimum wage.

A lower minimum wage and regressive tax changes sent a clear signal that maintaining fairness was not a priority.

And policies and tactics that undermined the ability of workers’ to join unions and exercise their right to collectively bargain weakened a critical institution that has long fought for fairness in the labor market, and served to strengthen the middle class, both for union members and nonmembers.

Consequences

While we rightly celebrate the achievements of those who have been able to scale new heights of success in our economy, the shift toward becoming more of a winner-take-all economy has also had a number of adverse consequences for the U.S. economy that merit great concern.

I’ll highlight three.

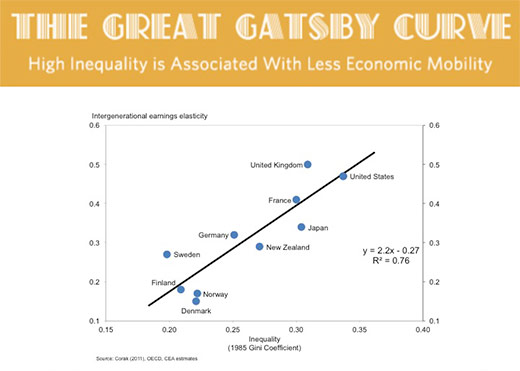

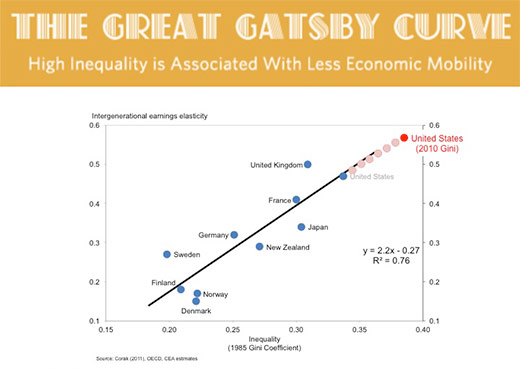

First, the three-decades’ long stagnation in real income for the bottom half of families threatens our long cherished goal of equality of opportunity. In a winner-take-all society, children born to disadvantaged circumstances have much longer odds of climbing the economic ladder of success. Indeed, research has found that countries that have a high degree of inequality also tend to have less economic mobility across generations.

This is shown in the next chart, which displays a plot of the degree of income mobility across generations in a country on the Y-axis (the intergenerational income elasticity) against a measure of the extent of inequality in that country in the mid-1980s (the Gini coefficient for after-tax income) on the X-axis.

A little over a year ago, I called this relationship “the Great Gatsby curve,” because F. Scott Fitzgerald’s novel highlighted the inequality of the Roaring ‘20s and class distinctions – I had no idea they would remake the movie as a result!

Each point in the graph represents a country. Higher values along the X-axis reflect greater inequality in family resources roughly around the time that the children were growing up. Higher values on the Y-axis indicate a lower degree of economic mobility across generations. The points cluster around an upward sloping line, indicating that countries that had more inequality across households also had more persistence in income from one generation to the next. Note that the U.S. is on the upper right of the line, indicating that we have both high inequality and low mobility.

The rise in inequality since the 1980s is likely to move us further out on the Great Gatsby Curve.

Quantitatively, the persistence in the advantages and disadvantages of income passed from parents to children is predicted to rise by about one quarter for the next generation as a result of the rise in inequality that the U.S. has experienced over the last 25 years.

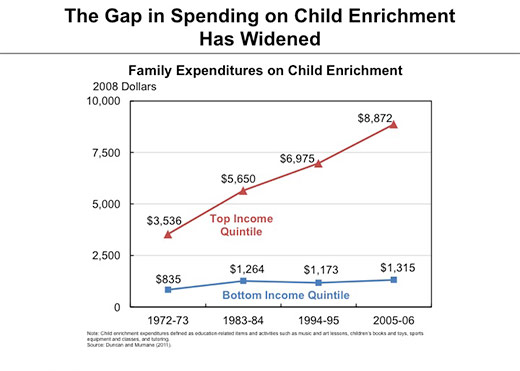

We are already seeing a growing gap in the enrichment activities provided to children born to higher and lower income families.

This next chart shows that since the 1970s expenditures on educated-related activities – including music and art lessons, books and tutoring – have been growing for children in families in the top 20 percent of income earners, but stagnant for children in the bottom 20 percent.

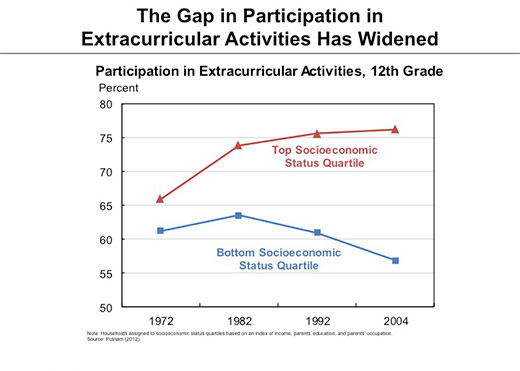

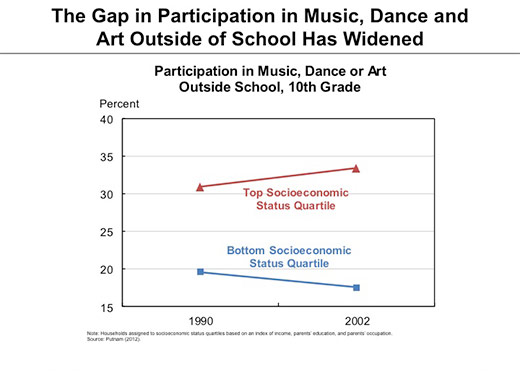

And the following chart shows that there is a growing gap between the top and bottom in participation in extracurricular activities at school.

And there is also a widening gap in participation in music, dance and art outside of school.

Children of wealthy parents already have much more access to opportunities to succeed than do children of poor parents, and this is likely to be increasingly the case in the future unless we ensure that all children have access to quality education, health care, a safe environment and other opportunities that are necessary to have a fair shot at economic success.

There is a significant cost to the economy and society if children from low-income families do not have anything close to the opportunities to develop and apply their talents as their more fortunate counterparts from better-off families, who can attend better schools, receive college prep tutoring, and draw on a network of family connections in the job market.

Diverse observers from Raghuram Rajan of the University of Chicago to Robert Reich of Berkeley have suggested a second way in which rising inequality and slow income growth for the vast middle class have harmed the U.S. economy – namely, by encouraging families to borrow to try to maintain consumption, a practice which cannot go on forever, and by reducing aggregate consumption. As a result of the rise in inequality, the amount of income going to the top 1 percent of American families has increased by about $1 trillion on an annual basis. Because the middle class has a higher propensity to spend their income than the top 1 percent, this curbs consumption. An increasingly top-heavy distribution of income is a drag on aggregate demand and economic growth, and a contributing factor to credit bubbles.

President Obama made this point very clearly in a speech in Osawatomie, Kansas: “When middle class families can no longer afford to buy the goods and services that businesses are selling, it drags down the entire economy, from top to bottom.”

Third, an active line of research examines the connection between inequality and longer term economic growth. In a seminal study, Torsten Persson and Guido Tabellini found that in a society where income inequality is greater, political decisions are likely to result in policies that lead to less growth.

A recent IMF paper also finds that more equality in the income distribution is associated with more stable economic growth.

Historically, a growing middle class has led to new markets, supported economic growth and built stronger communities.

Growing the Economy from the Middle Out

In this year’s State of the Union Address, President Obama said, “We can either settle for a country where a shrinking number of people do really well, while a growing number of Americans barely get by, or we can restore an economy where everyone gets a fair shot, and everyone does their fair share, and everyone plays by the same set of rules.”

He went on to outline a robust set of proposals to grow the economy from the middle out, by creating more middle class jobs and opportunities for those who are struggling to make it to the middle class.

I’ll conclude by explaining why the President’s agenda makes so much sense for our economy. This slide summarizes key elements of the President’s proposals to rebuild the middle class.

First, we need to provide ladders of opportunity so we can fully utilize and develop the talents of everyone in our country. One example of such a policy is pre-school education. Much research has found that high quality pre-school pays for itself many times over down the road. All children should have access to a safe learning environment.

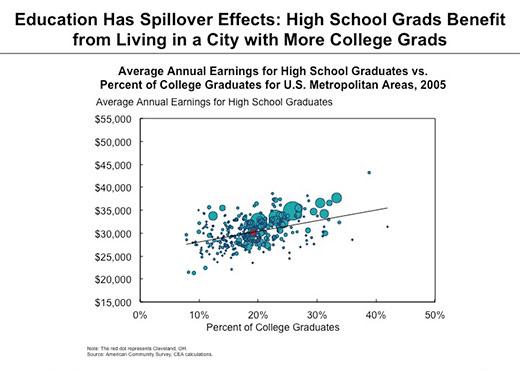

Second, the only force stronger than globalization is the strength of community. There are synergies within local areas. There is the reason why tech companies agglomerate in Silicon Valley or movie producers in Hollywood. And it is why Motown produced so much great music. There can be positive spillovers within communities.

Research by the economist Enrico Moretti, for example, shows that high school graduates benefit when the number of college graduates rise in an area.

The Obama Administration is committed to revitalizing distressed communities. The President’s Budget proposed to designate 20 of the communities hardest hit by the recession as “Promise Zones”. These “Promise Zones” will benefit from coordinated federal support to reduce crime, build more affordable housing, revamp schools, and attract private investment.

Third, the landmark Affordable Care Act expands access to health insurance coverage by providing subsidies for low- and moderate-income families, creates more competition and transparency in the insurance market, and gives providers and insurers new incentives to keep costs down.

Fourth, to restore fairness to our economy, President Obama has proposed raising the minimum wage to $9 an hour and indexing it so it rises with inflation. This would bring the real value of the minimum wage back to where it was in 1981.

Government actions and the use of the bully pulpit can also strengthen norms of fairness when it comes to private sector pay.

As part of the Wall Street Reform Act, for example, the President signed legislation that requires a nonbinding shareholder vote on the pay of top executives at public companies, called “Say-on-Pay”. About 3 percent of companies had shareholders vote against executive pay packages in Say-on-Pay votes in 2012. Although this may seem small, there were some very consequential and newsworthy negative votes, including at Citigroup and Hewlett-Packard. About one in four of the companies that lost Say-on-Pay votes in 2011 subsequently replaced their CEO. Moreover, the fact that pay packages must now be aired in front of shareholders should cause at least some compensation committees to moderate their proposals.

President Obama has also proposed limiting the pay of federal contractors to the same salary received by the President himself, which was $400,000 this year (before he voluntarily returned 5% of his salary to the Treasury out of sympathy for federal workers who were forced to take pay cuts due to furloughs under the budget sequester). The current rules governing pay for federal contractors permits top managers at these firms to be reimbursed in line with the pay of top private sector CEOs. The contractor reimbursement level has skyrocketed by more than 300 percent since the mid-1990s, and the top rate is slated to rise from $763,000 to $950,000 this year if action is not taken. This proposal not only reduces waste and inefficiency in government, but also represents another step towards strengthening norms of fairness in pay setting.

In addition, the American Taxpayer Relief Act, which passed at the beginning of this year and allows tax rates on the top 2% of income earners to return to where they were in the Clinton years, restores more fairness to our tax code, while maintaining tax breaks for middle class families.

The manufacturing and construction industries were hit particularly hard by the Great Recession, and manufacturing languished before the recession. These industries provide relatively many middle class jobs, especially for workers with less than a college degree. To revitalize manufacturing, the President has proposed to create Institutes of Manufacturing Innovation, and one has already been launched in Youngstown, Ohio. He has also proposed investing more in our infrastructure. It makes tremendous economic sense to repair and rebuild our roads and highways, ports and airports, when unemployment is high in the construction sector and interest rates are low. This would put more people back to work today and improve our competitiveness tomorrow.

Finally, all of these President’s proposals were made in the context of a sustainable federal budget. The budget is a means to an end, not an end in itself. President Obama has insisted on a balanced approach to deficit reduction that closes loopholes for the well-off and well-connected and addresses our long-run entitlement problems, while protecting the middle class and making key investments in infrastructure and research and development, which will raise our living standards in the future.

We should not expect problems that have built up over decades to be solved overnight, but the President’s proposal would put us on a path to rebuild the middle class.

Conclusion

One of my predecessors as Chairman of the Council of Economic Advisers, Arthur Okun, wrote an influential book called, Equality and Efficiency: The Big Tradeoff. Okun argued that policies that increase equality often reduce efficiency.

But given the dramatic rise in inequality in the U.S. over the past three decades, we have reached the point where inequality is hurting the economy. Today, a reduction in inequality would be good for efficiency, economic growth and stability.

Growing the economy from the middle out is not only an economic necessity; it is also a national imperative. Our system of government as well as our economy work better when we have a rising, thriving middle class, with broad common interests.

The expanding middle class in the post-war period was a defining experience for our country. Just like music, this shared growth and prosperity helped bring the nation together.

President Obama captured the changes sweeping our economy well when he said, “The world is faster and the playing field is larger and the challenges are more complex. But what hasn’t changed – what can never change – are the values that got us this far. We still have a stake in each other’s success. We still believe that this should be a place where you can make it if you try. And we still believe, in the words of … [Theodore Roosevelt that] ‘The fundamental rule of our national life, the rule which underlies all others – is that, on the whole, and in the long run, we shall go up or down together.’” And I agree with the President that America is still on the way up.