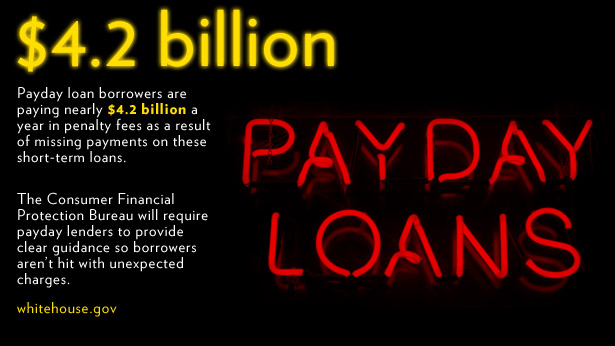

Payday loans, sometimes called cash-advance loans or check-advance loans offer borrowers short‐term funds at very high interest rates that are not always clearly disclosed. On average, payday lenders charge fees of roughly $16 for a $100 two‐week loan. If borrowers miss payments, fees can begin to accumulate, resulting in extremely high total payments. Payday loan borrowers are paying nearly $4.2 billion in fees annually, according to some studies.

Even when rates and penalties are disclosed, borrowers in desperate need of cash may agree to disadvantageous loan terms. Many times, these borrowers’ financial resources have already been depleted by an emergency, sustained unemployment, or illness. Relying on payday loans to make ends meet can create a debt‐and‐fee‐spiral that some people may find extremely difficult to exit.

The Consumer Financial Protection Bureau was established to provide federal supervision and oversight over a full range of financial service providers that consumers rely on--from banks and credit unions, to payday lenders and independent mortgage brokers. President Obama has nominated Richard Cordray to head the CFPB, and the Senate will vote on his confirmation this week. Having a director in place will allow the Bureau to protect consumers from unfair, deceptive, or abusive practices from providers like those that issue payday loans.